Construction Activity Still Strong as Fed Battles Inflation

As the U.S. now enters summer, the economic recovery's epic battle between post-pandemic, built-up demand and supply chain-fueled inflation continues to play out on a global scale. And Wall Street's slide this month into "bear market" territory for the first time since the start of the pandemic has only added to the anxiety.

All of which last week prompted the Federal Reserve Bank to act aggressively yet again, raising its benchmark interest rate by three quarters of a point at its June meeting, the Fed's largest increase since 1994. This came after raising the same rate by half a point in early May. And more increases may yet come this summer.

"The labor market is extremely tight, and inflation is much too high," said Fed Chair Jerome Powell (above) on June 15. "The economy and the country have been through a lot over the past two-and-a-half years and have proved resilient. It is essential that we bring inflation down if we are to have a sustained period of strong labor market conditions that benefit all."

Toward that end, he added, "We have both the tools we need and the resolve it will take to restore price stability on behalf of American families and businesses."

Speaking to ABC News last week, U.S. Treasury Secretary Janet Yellen, herself a former Fed chair, said, "I don't think a recession is at all inevitable."

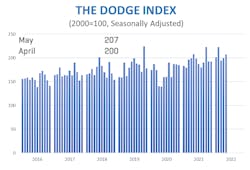

Even so, "the very aggressive stance taken by the Federal Reserve to combat inflation risks slowing the momentum in construction,” noted Richard Branch, chief economist for the Dodge Construction Network. On June 17, Dodge reported that total U.S. construction starts rose 4% in May to a seasonally adjusted annual rate of $979.5 billion, fueled by a 20% surge in nonresidential building starts.

But "the construction sector has become increasingly bifurcated over the past several months," noted Branch. "Nonresidential building construction is clearly trending higher with broad-based resilience across the commercial, institutional and manufacturing spaces. However, growth in the residential market has been choked off by higher mortgage rates and rapidly falling demand for single-family housing."

The latest hike in interest rates "has really made the Fed's job of engineering a soft landing increasingly difficult, and the odds of a U.S. recession occurring in 2023 have risen sharply," he added. "Simulations of a recession on our construction starts model would suggest a pretty significant pullback in 2023 were a recession to occur... So, there's reasonably smooth sailing for now, but be prepared for a potential softness in the market later this year and into early 2023."

Year-to-date, total construction was 6% higher in the first five months of 2022 compared to the same period of 2021, according to Dodge.

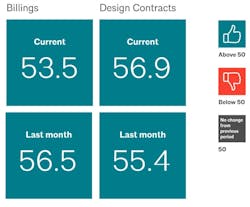

On June 22, the American Institute of Architects (AIA) released its own latest economic measure, the monthly Architecture Billings Index (ABI). The index's score for May was 53.5, down from April’s tally of 56.5. However, any score above 50 indicates an increase in billings from the prior month, AIA noted. Also in May, both the new project inquiries and design contracts indexes expanded, posting scores of 63.9 and 56.9, respectively.

“The strength in design activity over the past three months has produced a broader base of gains," said AIA Chief Economist, Kermit Baker, Hon. AIA, PhD. “With the improvement in inquiries and new design projects, demand for design services will likely remain high for the next several months, despite strong economic headwinds.”

Indeed, industry data still supports optimism, at least for the short term.

Associated Builders and Contractors (ABC) reported last week that its monthly Construction Backlog Indicator (CBI) increased to nine months in May from 8.8 months in April, according to an ABC member survey conducted between May 17 and June 3. That reading was up one month from where it was for May 2021.

“It is simply remarkable that contractors continue to add to backlog amidst global strife, rising materials prices and ubiquitous labor force challenges,” said ABC Chief Economist Anirban Basu. “Backlog is up in every segment over the past year, including in the somewhat shaky commercial category. The largest increase in backlog has been registered in the industrial segment. More American companies are committing to place additional supply chain capacity in the United States, with Intel and Ford representing particularly recent and noteworthy examples.

At the same time, ABC also logged a downturn in its Contractor Confidence Index (CCI), which dropped to 60.9 in May from 63.1 in April.

“For contractors, the challenge will continue to be the cost of delivering construction services,” said Basu. “The risk of severe increases in costs and substantial delays in delivery remains elevated given the volatility in input prices, the propensity of the labor force to shift jobs in large numbers and equipment shortages and delays. This ABC survey indicates that the proportion of contractors who expect that profit margins will expand over the next six months is declining, a reflection of lingering, worsening supply chain challenges.”

Of course, the more materials prices and wages rise, the more elusive profits prove to be for contractors and design firms. The latest monthly data released last week by the U.S. Census Bureau demonstrate the ongoing squeeze.

According to Associated General Contractors (AGC), contractors’ bid prices for constructing new nonresidential buildings finally caught up with soaring costs for the materials and services they buy in May. As a result, AGC cautioned that contractors will have a hard time keeping pace with additional price spikes for many key construction materials.

“After enduring more than a year of runaway increases in the cost of items needed to build projects, contractors have finally raised their bid prices by an equivalent amount,” said AGC Chief Economist Ken Simonson. “But the runup in materials costs appears likely to continue to pressure contractors’ profit margins.”

The producer price index (PPI) for inputs to new nonresidential construction —the prices charged by goods producers and service providers such as distributors and transportation firms— rose 1.9% from April to May and 18.9% since May 2021, following 12 consecutive months of 20% or greater increases. An index for new nonresidential building construction —a measure of what contractors say they would charge to erect five types of nonresidential buildings— rose 0.4% for the month and 19.3% from a year earlier.

A wide variety of inputs accounted for the increase in the cost index, making further increases likely in the near term, the economist added. The price index for diesel fuel jumped 84.9% over 12 months. The index for liquid asphalt leaped 80.5%. The indexes for steel mill products and aluminum mill shapes climbed 32.9% and 31.2%, respectively. The index for architectural coatings such as paint soared 31.6%. There were increases of more than 20% in the indexes for plastic construction products, which rose 29.5%; truck transportation of freight, 25.8%; and gypsum building materials, 23.9%.

In addition, there were double-digit increases in several other price indexes that affect construction costs, Simonson noted. He cited as examples the index for roofing asphalt and tar products, which rose 18.9% over 12 months; insulation materials, 16.6%; paving mixtures and blocks, 16.1%; concrete products, 12.0%; and construction machinery and equipment, 11.5%.

AGC officials said ongoing increases in materials costs will continue to threaten the profit margins of many contractors. They urged federal officials to remove remaining tariffs on key construction materials, rethink newly released federal "Buy America" policies and address constrained supply chains in order to lower costs.

“Higher construction prices run the risk of forcing public agencies and private developers to rethink planned projects,” said AGC CEO Stephen E. Sandherr. “Federal officials need to remove remaining tariffs, support a competitive materials market, and take every possible step to support a supply chain struggling to restart after the pandemic.”

As a stop-gap measure to relieve inflation this summer, the White House has called on Congress to approve a 90-day federal tax holiday on fuel prices, which could save consumers as much as 18 cents per gallon. But industry groups fear that such a move would do more harm than good, since the loss in federal revenue would come out of the Federal Highway Trust Fund for infrastructure projects.

Even so, the short-term relief for summer travelers may prove too attractive for Congress to resist, especially ahead of the national mid-term elections next fall.

Stay tuned...