As Industry Holds Its Breath, Project Pipeline Begins to Slow

Two months ago in this space, I referenced a 'Godot Recession', the long-predicted economic downturn that so far had yet to materialize. Well, now, perhaps tired of waiting, the U.S. government seems poised finally to bring on that recession for little reason other than political spite.

If a deeply divided Congress fails to raise the national debt ceiling by June 1 (aka "the X-date"), then a self-inflicted "economic catastrophe" may actually happen, according to U.S. Treasury Secretary Janet Yellen. And those consequences threaten to be far worse than any run-of-the-mill, cyclical setback.

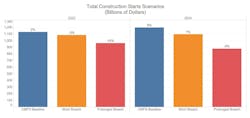

On May 16, industry analyst Dodge Construction Network stated plainly that if the debt ceiling is not raised on time and the dispute is prolonged into July, then "construction starts would fall 14% in 2023, and fall a further 9% in 2024. In many ways, this is akin to the impact of the financial crisis on starts in the 2007-2009 period."

Of course, that stretch of U.S. history is now known as the "Great Recesssion."

For its part, Moody's Analytics first looked at those dual scenarios in early May and concluded grimly: "It is increasingly important to consider the possibility that lawmakers fail to act in time and there is a breach of the debt limit. We now assign a 10% probability to a breach. If there is a breach, it is much more likely to be a short one than a prolonged one. But even a lengthy standoff no longer has a zero probability. What once seemed unimaginable now seems a real threat."

On May 20, The New York Times further added:

It might not take a default to damage the U.S. economy. Even if a deal is struck before the last minute, the long uncertainty could drive up borrowing costs and further destabilize already shaky financial markets. It could lead to a pullback in investment and hiring by businesses when the U.S. economy is already facing elevated risks of a recession, and hamstring the financing of public works projects. More broadly, the standoff could diminish long-term confidence in the stability of the U.S. financial system, with lasting repercussions.

Emerging consequences, disquieting signs

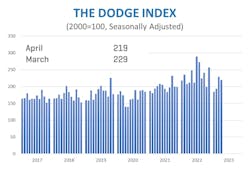

On May 18, Dodge reported that total U.S. construction starts fell 4% in April to a seasonally adjusted annual rate of $1.04 trillion. Nonresidential starts led the way as manufacturing projects dropped 22%. following strong performance in March. To balance the decline, nonbuilding starts climbed 7%, and residential building starts gained 12%.

On a year-to-date basis through April, total construction starts were 7% below the first four months of 2022. For the 12 months ending April 2023, total construction starts were 11% higher than the 12 months ending April 2022. Nonresidential and nonbuilding starts both showed gains at 34% and 24%, respectively.

“The construction sector continues to sweep its economic worries under the rug, even with inflation, unstable banking, and the potential breach of the U.S. debt ceiling,” said Dodge Chief Economist Richard Branch. “While the presence of, or lack thereof, large manufacturing projects each month has made the data more volatile, the underlying trends point to a very healthy sector. However, this is likely transitory. The Dodge Momentum Index, which tracks projects entering the earliest stages of planning, is falling, which should lead to weaker starts in the second half of the year – especially for the private sector.”

As measured by Dodge, nonresidential building starts declined 22% in April to a seasonally adjusted annual rate of $383 billion. This sharp decline follows an equally large bump in March, when numerous large manufacturing projects climbed dramatically. In April, however, factory starts plummeted 68%. Institutional starts also dropped 13%, largely due to a pullback in healthcare construction. Meanwhile, commercial starts actually improved 5% thanks to an increase in retail and office construction.

Year-over-year, in January 2023 through April 2023, total nonresidential starts were 7% higher than in the first four months of 2022. Institutional starts gained 14%, manufacturing starts were still 4% higher, and commercial starts were up 2%. Between April 2022 and April 2023, total nonresidential building starts were 34% higher than April 2021 through April 2022. Manufacturing starts were 118% higher, institutional starts improved 22%, and commercial starts were up by 18%.

Engineering Business Sentiment Split

Passed in late 2021, "the Infrastructure Investrment and Jobs Act (IIJA) has absolutely buoyed our industry," said Joe Bates, a senior consultant at the American Council of Engineering Companies (ACEC) Research Institute. Speaking on ACEC's May podcast, he added, "If the economy does go into a mild recession, it will not hit our industry this year."

Previewing the institute's soon-to-be-released Engineering Business Sentiment Study for the second quarter of 2023, Bates noted that the 500-plus ACEC members surveyed this spring displayed a "huge disconnect" between their feelings about the economy, in general, and the business prospects for their own firms. "For the last year, future sentiment overall has been very pessimistic, but individual firm sentiment for the next 12 months has actually improved," he explained.

Of particular note, Bates added that the latest survey continued to find inflation and recession fears as the main concerns for ACEC members, but a new worry had also emerged. "Political concerns and uncertainty jumped nine points on our list to move into the third slot," he said.

Longer term, Bates said firms appear most worried about worker shortages and resulting wage inflation. "We simply do not have enough engineers in the pipeline in this country, much less in our sector of the economy," he added.

Overall, construction employment increased in 24 states in April from the previous month, according to the latest data from the Bureau of Labor Statistics (BLS). Compared to April 2022, however, 42 states reported increased construction hiring.

"Contractors continue to report strong demand for projects and have added employees in all but a handful of states over the past year," said Ken Simonson, chief economist for Associated General Contractors of America (AGC). So, any slowdown in hiring this spring seems more attributable to worker shortages, he explained.

On May 16, Associated Builders and Contractors (ABC) also entered the economic discussion, reporting that its Construction Backlog Indicator had increased to 8.9 months in April, up slightly from 8.7 in March, according to an ABC member survey conducted April 20 to May 3. The latest reading is also 0.1 months higher than in April 2022.

- View ABC’s Construction Backlog Indicator and Construction Confidence Index tables for April. View the historic Construction Backlog Indicator and Construction Confidence Index data series.

After declining to a seven-month low in March, backlog rebounded in April due to strength in the infrastructure category. Regionally, backlog increased in the Northeast and West, but fell in the South and middle states, ABC reported.

Also in April, the nonunion contractor group's Construction Confidence Index for sales and staffing moved higher, while the readings for profit margins inched lower. Still, all three readings remained above the threshold of 50, indicating expectations of growth over the next six months.

“Based on ABC member sentiment, one would not be able to discern that interest rates are high, the nation’s banking sector is in tumult, politicians are arguing over the nation’s debt limit and recession fears remain pervasive,” said ABC Chief Economist Anirban Basu. “Despite many headwinds and an active news cycle, contractors continue to express confidence in the near term."

Indeed, engineering firms remain individually upbeat, as well, according to ACEC.

The only thing that threatens to shatter that confidence right now is the ominous debt ceiling debate dominating D.C. If cooler heads fail to prevail there in the next 10 days, then our nation will suffer its first-ever default.

And none of us truly know what is on the other side of that dark door.

##########