In October 1974, just two months removed from Richard Nixon's unprecedented resignation, President Gerald Ford spoke to a joint session of Congress and defined what he saw as the greatest threat to the nation.

"We must whip inflation right now," Ford said in a nationally televised address. "I say to you with all sincerity that our inflation, our Public Enemy #1, will, unless whipped, destroy our country."

At that time, U.S. inflation was 10% and would soon rise to 12% before receding. A major contributing factor to that climb and to international political instability, overall, had been the Middle East oil embargo that followed the Yom Kippur War in October 1973, and that ended five months later. Even so, the oil crisis had already triggered a global economic recession that would last into early 1975.

After Ford's speech, the federal government printed up millions of red "Whip Inflation Now" (WIN) buttons for national distribution to rally the American public to the cause. Needless to say, results were mixed.

Some 49 years later, as war now once again flares in the Middle East, and Congress creaks with familiar dysfunction, it is downright eerie to see inflation back on top of our list of worries.

To put things in historical perspective, the U.S. core inflation rate for September 2023 was 3.7%, down from a post-pandemic high of 8.5% early last year. Even so, Federal Reserve Bank Chair Jerome Powell is not satisfied. Speaking Oct. 19 at the Economic Club of New York, he said, "Inflation is still too high, and a few months of good data are only the beginning of what it will take to build confidence that inflation is moving down sustainably to our (2%) goal.”

With that in mind, some expect the Fed will again raise interest rates when it meets in early November. But no one is certain. The central bank chose not to raise rates at the end of September and may well stay on that course.

“Doing too little could allow above-target inflation to become entrenched and ultimately require monetary policy to wring more persistent inflation from the economy at a high cost to employment,” Powell explained. “Doing too much could also do unnecessary harm to the economy.”

Nobel Prize-winning economist Paul Krugman thinks the Fed has already done enough.

"The most important reason for optimism is that an ever-widening range of indicators suggests that the conventional wisdom — that we needed a recession to bring inflation under control — was wrong," he wrote said Krugman on Oct. 18, writing in his weekly New York Times column. "Instead, we seem close to returning to the Federal Reserve’s inflation target without paying much of a price at all."

Pointing to "multivariate core trend" of personal consumption expenditures (PCE) inflation, as tracked by the Federal Reserve Bank of New York, he added, "These measures suggest that underlying inflation is already most of the way back to the Fed’s target of 2% and falling fast. The war on inflation looks almost over, and we won."

That remains to be seen, of course. But we'll see what the Fed has to say in two week's time.

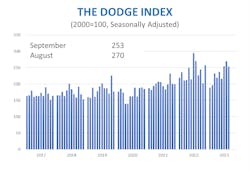

Drilling down more specifically into the AEC industry, the Dodge Construction Network released its latest monthly data on Oct. 18. It reported that total U.S. construction starts fell 6% for in September to a seasonally adjusted annual rate of $1.2 trillion. Nonresidential starts lost 4%, residential starts declined 6%, and nonbuilding starts fell 9%.

Year-to-date through September 2023, total construction starts were 3% below that of 2022. Residential and nonresidential starts were down 17% and 7%, respectively. However, nonbuilding starts were up 25% on a year-to-date basis. For the 12 months ending September 2023, total construction starts were unchanged. Nonbuilding starts were 22% higher, and nonresidential building starts gained 3%. Conversely, on a 12-month rolling basis, residential starts posted a 16% decline, according to Dodge.

“Risks continue to mount for the construction sector,” said Dodge Chief Economist Richard Branch. “Over the last 12 months, construction starts have essentially been flat, as rates increased and credit tightened. The industry needs further adjusting as rates are expected to stay higher for longer, along with the potential for higher energy costs and continued political uncertainty. A return to broad-based growth in construction starts is still some time away.”

By that, Branch means next summer, according to his latest YouTube update.

Nonresidential breakdown

Nonresidential building starts fell 4% in September to a seasonally adjusted annual rate of $459 billion. Commercial starts rose 6% due to strength in data center work (classified as an office structure in the Dodge database) and retail. Institutional starts fell 8% in September despite a healthy gain in education starts, and manufacturing starts declined 13%. On a year-to-date basis through September, total nonresidential starts were 7% lower than that of 2022. Institutional starts gained 5%, while commercial and manufacturing starts fell 6% and 31%, respectively.

For the past 12 months ending in September 2023, total nonresidential building starts were 3% higher than that ending September 2022. Manufacturing starts were 8% lower. Institutional starts improved by 8%, and commercial starts gained 4%.

According to Dodge, the largest nonresidential U.S. building projects to break ground in September were the $2.5-bil. Hyundai/SK EV battery plant in Cartersville, GA, a $1.1 billion prison in Elmore, AL, and the $1-bil. Microsoft data center in Mount Pleasant, WI.

"It's really interesting to see this bifurcation in the market," said Branch. "Publicly funded projects like infrastructure and education, plus manufacturing and healthcare, are doing reasonably well. But it's the private side of the market, whether it's residential or income-property types like office or warehouse, that are especially weak over the last 12 months."

##########

About the Author

Rob McManamy

Editor in Chief

An industry reporter and editor since 1987, McManamy joined HPAC Engineering in September 2017, after three years with BuiltWorlds.com, a Chicago-based media startup focused on tech innovation in the built environment. He has been covering design and construction issues for more than 30 years, having started at Engineering News-Record (ENR) in New York, before becoming its Midwest Bureau Chief in 1990. In 1998, McManamy was named Editor-in-Chief of Design-Build magazine, where he served for four years. He subsequently worked as an editor and freelance writer for Building Design + Construction and Public Works magazines.

A native of Bronx, NY, he is a graduate of both the University of Virginia, and The John Marshall Law School in Chicago.

Contact him at [email protected].