HIGH-WIRE ACT: Despite Concerns, Pent-Up Pandemic Demand Driving Rebound

Even as the surging Delta variant now threatens to reverse months of hard-won progress against the pandemic across the U.S., the latest economic data has bolstered optimism for a sustained recovery. Meanwhile, Congress also seems poised (finally) to deliver a long-awaited, $1-trillion infrastructure package, ostensibly ahead of the looming August recess.

Combined, the positive trends also support the latest American Institute of Architects' Consensus Construction Forecast. Released July 28, AIA's semi-annual amalgamation of nine industry economists and forecasting agencies is still predicting solid growth in 2022 (see chart, below). "Pent-up demand from the pandemic is creating a general spending surge," noted Kermit Baker, AIA's chief economist. "Construction looks to get its share of the benefits in the next two years."

More than a little of that share seems likely to be spurred by new federal infrastructure spending, which moved closer to reality on July 28, when the U.S. House of Representatives announced that it had reached an agreement on a bipartisan package.

“Today’s announcement that a deal has been reached on a bipartisan infrustructure package is a huge step forward for the country, and America’s engineering industry is ready to get to work," said Linda Bauer Darr, president and CEO of the American Council of Engineering Companies (ACEC). "We urge lawmakers to work together to get it done... We urge every member of the Senate to vote yes on cloture and move forward on infrastructure.”

Meanwhile, other encouraging signs emerged last week, as well.

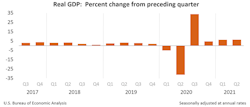

On July 29, the U.S. Bureau of Economic Analysis (BEA) reported that real gross domestic product (GDP) had increased at an annual rate of 6.5 percent in the second quarter of 2021, up from the first-quarter's (revised) GDP rise of 6.3%.

"The increase in second quarter GDP reflected the continued economic recovery, reopening of establishments, and continued government response related to the COVID-19 pandemic," explained BEA in its report. "In the second quarter, government assistance payments in the form of loans to businesses and grants to state and local governments increased, while social benefits to households, such as the direct economic impact payments, declined," the report noted.

Some economists had expected a larger second-quarter rise, but several factors contributed to limit its strength.

“Today's GDP report was terrific by normal standards, but these days are hardly normal,” said Anirban Basu, chief economist for Associated Builders & Contractors (ABC). “While overall GDP expanded during the second quarter at a pace broadly consistent with the first quarter, investment in structures contracted (by 7%). There were many reasons for this, including labor shortages, snarled supply chains and rising materials costs. Another factor is weakness in certain commercial real estate segments, with developers investing less in retail, lodging, and office categories."

Despite these signs of weakness, ABC’s Construction Confidence Index still shows that contractors expect sales, profit margins and hiring all to increase over the second half of 2021, added Basu. “Despite the lingering pandemic and elevated materials prices, demand for construction services remains high," he noted. "Individual firms generally remain confident about the future given the presence of demand for their services as well as rising backlog.”

AIA Consensus Construction Forecast, July 2021

Design firms are encouraged, as well, so there is real optimism in the outlook for construction spending this year and next. After declining about 2% last year, the AIA Consensus Construction Forecast panel in its mid-year update is projecting that spending on nonresidential buildings will decline an additional 3.9% this year – an upgrade from its earlier 5.7% decline forecast at the beginning of the year. Then, 2022 will see a robust 4.6% increase in spending, the AIA panel predicts.

Of course, even that growth is not expected to come easy, however.

"While momentum is developing behind most of the nonresidential building sectors, there are several potential potholes on the road to a construction recovery,” conceded AIA's Baker. “Inflation is back on the radar screen given the surge in consumer spending, as well as the growing federal debt levels. Also, the global supply chain continues to face serious challenges that persist even well after initial pandemic-related disruptions have largely subsided.”

- To view the interactive version of the below chart, click here.

Even so, in 2022, virtually all the nonresidential building sectors are expected to see healthy growth, paced by hotels, as well as amusement and recreation projects, both markets that saw steep declines during the pandemic.

"The recovery from the COVID-19 pandemic has begun but is very uneven," stated Richard Branch, chief economist for Dodge Data & Analytics. "Commercial construction has been buoyed by strength in the warehouse sector as large e-commerce companies build out their logistics infrastructure...The dollar value of commercial and multifamily starts should continue to improve over the coming six months; however, growth will remain muted due to high material prices and a shortage of skilled labor in the construction sector."

For its part, Dodge Data is currently forecasting a 4.7% increase in overall construction spending next year, led by an 11.1% surge in U.S. commercial construction contracts.

Retrofits of existing buildings surge

In spite of the emerging headwinds to a stronger design and construction recovery, there are other factors that potentially could produce growth beyond what might be expected, noted Baker in the AIA Report. As well as the need for additional building space, architecture firms are already reporting growing demand for retrofitting existing buildings, particularly in light of post-pandemic concerns, he wrote.

Somewhat surprisingly, Baker added, building sectors where firms had seen the greatest gains in retrofitting were manufacturing and distribution, multifamily residential, and many of the key institutional building types (healthcare, education, corrections, government).

Overall, while it will take a while for the recent burst in design activity to translate into construction spending, the coming years look to generate healthy growth in construction activity, said AIA.

A semi-annual forecast survey conducted by the Urban Land Institute this past May reported that the consensus is that over the coming years, vacancy rates will decline and rents will increase for multifamily rentals, offices, retail facilities, lodging, and industrial/warehouse facilities. A difference is that these two metrics are already better than their 20-year average for multifamily rentals and industrial/warehouse facilities, Baker noted.

For the commercial categories of offices, retail, and lodging, there needs to be significant catch-up before these metrics return to pre-pandemic levels. However, this is expected to happen by the end of 2023, he added.

Infrastructure package looms as catalyst

At press time, many were pinning their hopes on the apparently imminent prospect of that new federal infrastructure bill.

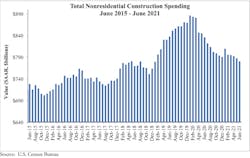

“The federal government has a real opportunity to boost nonresidential construction by passing the bipartisan infrastructure measure as quickly as possible,” said Stephen E. Sandherr, CEO of the Associated General Contractors of America (AGC). “The pandemic has created a tale of two construction industries, a residential market where demand continues to surge and a nonresidential market that is struggling to gain traction.”

So, stay tuned to see what actual nonresidential traction, if any, can be gained before the August recess. Either way, it is also good to remember where our industry was just last August, and to celebrate the resilience that so many of us somehow managed to find in an unrelenting maelstrom of uncertainty. May those dark days truly stay behind us.

##########

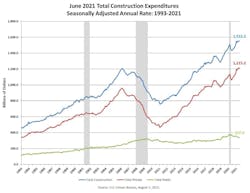

UPDATE: The charts below were just released Aug. 2, 2021...

WASHINGTON DC — The U.S. Census Bureau announced the following value put-in-place construction statistics for June 2021:

"Construction spending during June 2021 was estimated at a seasonally adjusted annual rate of $1,552.2 billion, 0.1 percent (±1.2 percent)* above the revised May estimate of $1,551.2 billion. The June figure is 8.2 percent (±1.3 percent) above the June 2020 estimate of $1,435.0 billion. During the first six months of this year, construction spending amounted to $736.5 billion, 5.4 percent (±1.0 percent) above the $698.8 billion for the same period in 2020."

##########