By ROB McMANAMY, HPAC Engineering

Month in and month out, for virtually all of this volatile economic year, the lead storyline for these monthly market reports has been remarkably consistent: engineering and construction work keeps growing, even in the face of epic and historic hurdles.

From a global pandemic that refuses to end and a war in Europe that continues to confound to rollercoaster inflation for fuel and material costs and supply chain woes that gum up everything, 2022 has never had a dull moment, it seems. Toss in political instability and bitter societal discord leading up to this fall's tense midterm elections across the country, and no one would be surprised if the U.S. economy were already in a dire nosedive.

And yet it is not.

Despite everything, including two consecutive quarters of slight declines in Gross Domestic Product (GDP), a pattern that long-defined an actual economic recession, the greater downturn has still not arrived. Even as the Federal Reserve Bank continues to raise interest rates this fall to combat inflation, actions universally expected to trigger recession, that result is still on hold.

"Since the onset of the pandemic, we’ve seen extraordinary activity and inconsistencies in the economy – both for good and bad," said Joseph Natarelli, CPA, National Construction Industry Group Leader, Marcum Advisors LLP. "While unemployment remains historically low... a strong on-shoring trend is driving growth of (domestic) construction-related to manufacturing. But it is not enough to offset declines and looming threats elsewhere."

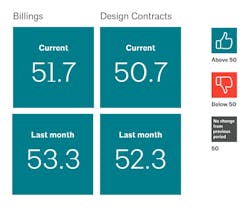

Even so, architecture firm billings still grew modestly in September, according the American Institute of Architects (AIA). Its latest monthly Architecture Billings Index (ABI) score of 51.7 means that slightly fewer firms reported increased billings than in August, when the score was 53.3.growth. Nevertheless, September marked the 20th consecutive month of positive (50+) growth for the ABI.

“Across the broader architecture sector, backlogs at firms remained at a robust 7.0 months as of the end of September, still near record-high levels since we began collecting this data regularly more than a decade ago,” noted AIA Chief Economist, Kermit Baker, Hon. AIA, PhD. “While billings in the Northeast region and in the Institutional sector reached their highest pace of growth in several years, there appears to be emerging weakness in the previously healthy multifamily residential and commercial/industrial sectors, both of which saw a decline in billings for the first time since the post-pandemic recovery began," he added.

September also saw slight declines in construction input prices, which was welcome, but also put into more sobering perspective by industry economists. On Oct. 12, the U.S. Bureau of Labor Statistics (BLS) released its latest Producer Price Index (PPI) data, which saw overall construction input prices dip 0.1% in September compared to the previous month. Nonresidential construction input prices also fell 0.1% for the month. The year-over-year numbers remain stark, however, as well as comparisons to the start of the pandemic.

“While nonresidential input prices fell slightly, inflation came in hotter than anticipated in the overall report," noted Anirban Basu, chief economist of Associated Builders and Contractors (ABC). "For contractors, the upshot is that they should be actively preparing their respective balance sheets for a downturn, even as many firms presently operate at capacity.”

Added Ken Simonson, chief economist for Associated General Contractors of America (AGC), "The price report shows that costs for construction continue to outpace those of other industries. Furthermore, the steep runup in diesel prices in the last few weeks is likely to make projects still more expensive to complete.”

Specifically, the PPI data for inputs to nonresidential construction—the prices charged by goods producers and service providers such as distributors and transportation firms—decreased 0.2% from August to September but nevertheless rose 12.6% since September 2021. That outpaced the 8.5% year-over-year rise in the overall producer price index for finished goods, Simonson noted.

Retail diesel fuel prices soared by 39 cents per gallon in the past week, bringing the year-over-year increase to $1.64 or 45.7%, Simonson added. He said construction is especially sensitive to diesel costs, because most projects require thousands of truckloads to deliver equipment and materials and to move or haul away dirt, debris, and equipment at the end of project.

AGC noted that prices of several widely used goods posted double-digit increases over the past 12 months. The PPI for diesel fuel leaped by 65.9% including 11.7% in September. The index for liquid asphalt, used in paving projects, jumped 43.3% despite an 11.8% decline last month. The index for paint and other architectural coatings rose 27.2% over 12 months. There were also unusually large year-over-year increases in the price indexes for gypsum products such as wallboard, 18.4%; plastic construction products, 17.9%; truck transportation of freight, 16.3%; asphalt and tar roofing materials, 15.3%; concrete products, 14.3%; insulation products, 13.4%; and flat glass, 10.3%.

“While many American nonresidential contractors remain upbeat, according to ABC’s Construction Confidence Index, there are significant threats looming over the industry,” added Basu. “Next year stands to be a weak one for the U.S. economy as it continues to absorb the impacts of rapidly rising borrowing costs."

Still, the industry momentum has remained defiantly resilient.

On Oct. 20, the Dodge Construction Network (DCN) reported that total U.S. construction starts fell 19% in September to a seasonally adjusted annual rate of $1.02 trillion. In September, nonresidential building starts dropped 23%, residential starts fell 11%, and nonbuilding starts declined by 25%. However, DCN Chief Economist Richard Branch was quick to point out that year-to-date, total construction was 16% higher in the first nine months of 2022 compared to the same period of 2021. Nonresidential building starts rose 37% over the year, residential starts were flat, and nonbuilding starts were up 20%, he noted.

For the 12 months ending September 2022, total construction starts were 15% above the 12 months ending September 2021. Nonresidential starts were 34% higher, residential starts gained 2%, and nonbuilding starts were up 17%.

“September’s decline in construction starts should not be seen as a precursor to a cyclical pullback in the industry,” said Branch. “The previous two months saw the start of several megaprojects, and the decline in September returns starts activity to its trend level. It is likely, however, that as interest rates move higher in the coming months, marginal construction projects may not get underway and construction activity will begin to settle back.”

Employment and expectations

In the meantime, construction hiring has struggled to keep up with overall industry demand.

According to AGC's analysis of the latest BLS data last month, construction employment had increased in 246 of 358 metro areas (69%) across the U.S. between August 2021 and August 2022. “The number would be still higher if contractors could find enough qualified workers,” noted Simonson. “The record number of construction job openings and ultra-low unemployment rate for workers with construction experience are signs of an ever-tighter labor market,” he added.

The unemployment rate for jobseekers with construction experience declined to 3.9% in August from 4.6% a year earlier. Simonson also noted that there were 393,000 job openings in construction at the end of July, the highest July total in the 22-year history of the BLS data.

“(ABC's) construction confidence and backlog metrics appear strong despite the U.S. economy facing headwinds,” said ABC's Basu. “Contractors remain decidedly upbeat, with backlog expanding and expectations for rising sales, employment and profit margins over the next six months... One would think the recent surge in interest rates would be enough to dampen contractor confidence. Instead, project owners continue to move forward with a significant number of projects. Faced with high demand for their services, contractors continue to show pricing power, helping to offset rising compensation and other construction delivery costs.”

For its part, AIA noted that the Conference Board’s Consumer Confidence Index (CCI) increased for the second consecutive month in September, with consumer optimism buoyed by wage growth and declining gas prices. In addition, concerns about inflation dipped to the lowest level since the beginning of the year, and optimism about the future increased as well. However, concerns about a potential recession persist among consumers, and confidence may decline if OPEC’s recent cut of oil production leads to higher gas prices again, added AIA economist Baker.

Still, AIA's latest "Work-on-the-Boards" monthly members survey included these relatively upbeat comments:

- “Hiring, resignations, and labor market competition seem to have stabilized. We’re in a good place to pull through the revenue we have in backlog, and will continue to be in a good place if some of our open opportunities start to solidify into real projects.”— 180-person firm in the West, commercial/industrial specialization;

- “Steady, but you can see more concern on the horizon with the change in interest rates.”—125-person firm in the South, residential specialization;

- “Contractors say they have a three-year backlog, so every construction project is taking longer to complete. That makes it harder to free up staff to work on new work.”—250-person firm in the Midwest, institutional specialization.

So, all told, our industry this fall still appears wary of what's to come, but just too busy to slow down and worry. At the end of the day, not the worst position to be in, by any means. In November, of course, economic forecast season begins in earnest. So next month, after the momentous U.S. midterm elections take place nationwide, we will return here to start taking a closer look at what 2023 may hold for all of our futures.

##########

About the Author

Rob McManamy

Editor in Chief

An industry reporter and editor since 1987, McManamy joined HPAC Engineering in September 2017, after three years with BuiltWorlds.com, a Chicago-based media startup focused on tech innovation in the built environment. He has been covering design and construction issues for more than 30 years, having started at Engineering News-Record (ENR) in New York, before becoming its Midwest Bureau Chief in 1990. In 1998, McManamy was named Editor-in-Chief of Design-Build magazine, where he served for four years. He subsequently worked as an editor and freelance writer for Building Design + Construction and Public Works magazines.

A native of Bronx, NY, he is a graduate of both the University of Virginia, and The John Marshall Law School in Chicago.

Contact him at [email protected].