Economy Rolls On As Storm Clouds Roll In

By ROB McMANAMY

In these uncharted waters of collective national angst, the choppy weekly waves of unexpected news, surprising economic data, and related wide-ranging emotions continue to keep business owners and project teams on constant alert.

This summer, the U.S. economy technically fell into recession after recording its second consecutive quarterly dip in the Gross Domestic Product (GDP). But even some economists now suggest that the traditional definition of recession may no longer apply, since other economic indicators on inflation and employment have continued to improve and show surprising resilience. At the same time, global supply chain issues have eased somewhat and massive federal funding of long-delayed infrastructure projects is moving forward.

Last week, even a potentially devastating national railworkers strike appears to have been averted at the 11th hour.

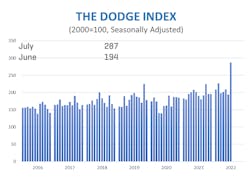

Many economic numbers specific to our industry alos remain encouraging. For instance, after slipping 5% in June, total U.S. construction starts rose a whopping 48% in July to a seasonally adjusted annual rate of $1.36 trillion, according to Dodge Construction Network (DCN). The large gain resulted from the start of three multi-billion-dollar manufacturing plants and two LNG export facilities. But even without these projects, total construction starts would still have increased 7%. Nonresidential building starts rose 79% in July, and nonbuilding starts jumped 120%, even as residential starts decreased 8%.

“Mega-projects aside, construction continues to improve despite the pressure created by higher interest rates and labor scarcity,” said DCN Chief Economist Richard Branch in August. “Combined with the strong labor market, this is another indicator that the U.S. is not currently in a recession. However, the Federal Reserve will continue to aggressively raise interest rates until they feel that inflation is under control. This will create mounting pressure on building activity and potentially lead to a slowdown in construction starts by year-end.”

Throiugh July, however, total construction was still 11% higher in the first seven months of 2022 compared to the same period in 2021. Nonresidential building starts rose 22% over the year, residential starts were 1% higher, and nonbuilding starts were up 16%.

Even so, the monthly Dodge Momentum Index (DMI) for August still ticked downward by 1.2%, thanks to a 5.6% drop in its institutional component. Meanwhile, the commercial component rose 1% in August. According to DCN, the DMI is its monthly measure of initial reports for nonresidential building projects in planning, shown to lead related construction spending by a full year.

“In spite of weak institutional planning activity, DMI remained elevated in August, just a notch below July’s 14-year high. This indicates continued confidence from owners and developers that nonresidential building projects will be realized in the coming year,” said DCN Senior Economist Sarah Martin on Sept. 8. “Weaker economic conditions and rising interest rates, however, may grind down overall consumer and business confidence as we move into 2023 — translating into fewer nonresidential building projects breaking ground.”

Confidence Up, Backlog Flat

On the subject of confidence, on Sept. 13, Associated Builders and Contractors (ABC) reported that its monthly Construction Confidence Index (CCI) readings for sales, profit margins and staffing levels all increased in August. The index for profit margins bounced back into positive territory while the sales and staffing level indices remained above 50, indicating expectations of growth over the next six months.

“Despite the high risk of recession, contractors collectively expect sales, employment and profit margins to grow over the next six months,” said ABC Chief Economist Anirban Basu. “Backlog is down from the cyclical peak in early 2022 and has been roughly flat in recent months.

“The buoyancy of the nation’s nonresidential construction marketplace is really quite remarkable,” said Basu. “Rising interest rates have already driven the single-family homebuilding market into recession, but brisk nonresidential activity continues. Many nonresidential contractors are operating at capacity, and their principal frustrations relate to supply-side issues like worker shortages, equipment delivery delays and elevated materials prices, as opposed to demand for their services.”

Meanwhile, ABC also reported that its Construction Backlog Indicator (CBI) remained unchanged at 8.7 months in August, according to an ABC member survey conducted Aug. 22 to Sept. 7. That result is a full month higher than reported in August 2021.

Overall, backlog is down from the levels of the second quarter of 2022, but remains higher than at any point from March 2020 to March 2022, the depth of the pandemic. While the CBI reading fell for contractors in the South in August, it remains the U.S. region with the lengthiest backlog, Basu noted.

Inflation Peaks, At Least for Fuel

On the inflation front, the price of materials and services used in nonresidential construction fell 1.4% in August, according to the latest Producer Price Index (PPI) data, released Sept. 14 by the U.S. Bureau of Labor Statistics (BLS). Still, those prices remained 16.7% above the August 2021 level. The monthly dip was driven by a steep drop in fuel prices, specifically 13.4% for diesel.

But that also masked increases in the cost of other construction inputs, according to an analysis by the Associated General Contractors of America (AGC) of the new BLS data. AGC cautioned that limited price declines cannot undo the harm of clogged supply lines and labor shortages. “Today’s price report highlights the mixed conditions contractors are experiencing, with many costs still rising sharply while others take a breather,” said AGC Chief Ecconomist Ken Simonson. “Meanwhile, an industry survey we recently released found that supply-chain issues and labor availability are delaying many construction projects.”

That survey, conducted with Autodesk and released Aug. 31, asked construction firms about the impact of shortages and delivery delays on project completion times, among other topics. Fully 82% of firms reported projects had been delayed due to longer lead times or shortages of materials, while 66% reported delays due to shortages of employees or subcontractors.

The PPI data for inputs to nonresidential construction—the prices charged by goods producers and service providers such as distributors and transportation firms—decreased 1.4% from July to August but nevertheless rose 16.3% since August 2021.

Prices of several widely used goods rose in August, partially offsetting declines for fuel, lumber, and some metal products prices. The price index for gypsum building materials such as wallboard jumped 3.3% for the month. Indices also rose for construction machinery and equipment (2.6%), flat glass (2.4%), copper and brass mill shapes (2.0%), ready-mixed concrete (1.6%), and asphalt paving mixtures and blocks (1.0 percent). Among services, the price index for equipment rental and leasing climbed 3.7%.

“Contractors welcome any relief they can get in the cost of most construction materials,” said AGC CEO Stephen E. Sandherr. “But it is still too hard to acquire most materials and prices remain quite elevated for many key products.”

For his part, ABC's Basu also urged caution. "(The PPI) report supplies additional evidence that wholesale inflation is edging lower from the highs observed earlier this year. While this may create a sense of relief among contractors, this is no time for complacency."

Though the pandemic has ebbed, its influence on the global economy and related ripple effects are far from over. And the war in Ukraine continues to threaten Europe in multiple ways.

"With COVID-19 lockdowns persisting in China, the world's leading manufacturer, and Europe facing severe energy crises, supply chain disruptions will persist," said Basu. "That suggests that construction materials and equipment prices are likely to remain elevated even if year-over-year price increases moderate. Public construction workers remain in short supply, including in the category of public construction. The upshot is that inflation is poised to remain stubbornly high even as some begin to declare victory. Estimators and others in the construction industry should be on guard for occasional surges in inflation during the months ahead."

Of course, the Federal Reserve Bank has been determined since spring to lessen those surges. And it was expected to raise its benchmark interest rate yet again this September, even if it brings on the recession that many fear.

"Exacerbating the current situation is the torrid pace at which the Fed is attempting to compensate for delaying the onset of initiating monetary tightening," wrote ITR Economics CEO Brian Beaulieu in his Sept. 16 blog. "It is reminiscent of what (former Fed Chair) Paul Volcker did in the early 1980s, when the Fed intentionally set out to squelch inflation regardless of the near-term impact upon the general economy... The Fed’s goal seems to be pushing the federal funds rate to around 4%. We will be at 3% to 3.25% after Sept. 21. This means we may be nearing a break in the Fed’s push to deter economic growth."

Construction employment, meanwhile, has continued to grow. In August, U.S. construction firms added 16,000 jobs, according to the latest monthly data from the Bureau of Labor Statistics (BLS).

“Nonresidential construction activity is growing, but contractors universally report difficulty hiring as many workers as they need,” added AGC's Simonson. “With the industry unemployment rate hovering below 4%, finding qualified applicants is sure to remain a major challenge.”

Total construction employment climbed to 7,708,000 in August as both residential and nonresidential construction firms added jobs for the month. Nonresidential firms added 4,300 employees, as gains of 700 jobs at general building contractors and 5,600 at nonresidential specialty trade contractors offset a loss of 2,000 at heavy and civil engineering construction firms. Employment in residential construction—homebuilders, multifamily general contractors, and residential specialty trade contractors—increased by 10,900 in August.

Compared to August 2021, the construction industry has added 311,000 jobs, an increase of 4.2%. The nonresidential sector added 191,600 of those yearly job gains, an increase of 4.4%. Meanwhile, residential construction firms added 118,700 jobs between August 2021 and August 2022, an increase of 4%.

The unemployment rate among jobseekers with construction experience fell from 4.6% in August 2021 to 3.9% in August 2022 month, Simonson noted. He said the low unemployment rate is consistent with the association’s recent Autodesk survey, which found that 93% of responding firms had open positions. Of those firms, 91% report having a hard time filling hourly craft positions, Simonson added.

Into the Crystal Ball

Looking ahead, the American Institute of Architects (AIA) this summer released the midyear update of its annual Consensus Construction Forecast, which combines the views of nine industry economists and forecasting agencies. Released July 18, the consensus outlook was not too stark, especially for next year.

"New project work coming into architecture firms, as well as inquiries for future projects, have been very strong, indicating design revenue at architecture firms will continue to grow," said AIA Chief Economist Kermit Baker upon release of the forecast. He added, "Growing workloads have pushed up backlogs at architecture firms, now averaging seven months and near their highest level since before the Great Recession (of 2008-09.)"

Challenges to the economy and the construction industry notwithstanding, Baker concluded, "The outlook for the nonresidential building market appears promising for this year and next.

##########