Extreme Data Points Cloud Economic Picture, But Progress Clear

In early February, national economic reports made U.S. history, both positive and negative. And each certainly had implications for our industry, which — like every other industry — is still desperate to break free from the two-year-old pandemic.

On Feb. 4, the U.S. Bureau of Labor Statistics (BLS) reported that the U.S. had gained 467,000 jobs on net in January 2022, and it also revised upward the numbers previously reported for November and December by an additional 700,000 jobs.

"This morning’s report caps off my first year as President. And over that period, our economy created 6.6 million jobs," noted President Biden after release of the BLS report. "If you can’t remember another year when so many people went to work in this country, there’s a reason — It's never happened before."

Just six days later, however, BLS also reported another number that had not happened in 40 years. The 12-month average for the Consumer Price Index recorded for January 2022 stood at 7.5%, the highest such figure recorded since February 1982. And this came after December's number came in at 7%. So, inflation has become an increasingly important factor for the construction industry, as well, as it continues to regain its footing and seek momentum in the new year.

“A year ago, Federal Reserve officials and many others thought that elevated inflationary pressures would have abated by now," noted Anirban Basu, chief economist for Associated Builders and Contractors (ABC), speaking in January. "Instead, materials prices remain elevated and generally continue to march higher," he said last month.

As global supply chain disruptions persist, alongside issues related to the ongoing Omicron variant of the Coronavirus, expect inflation to remain a concern at least through the first quarter of 2022, Basu added. "Among the other implications of materials price increases is the redesign of projects to substitute for expensive inputs, such as steel," he noted. "Not only does this put pressure on architects and engineers to identify alternative designs and materials, but it also means that contractors may end up working with inputs with which they are less familiar. At some point later this year, materials prices will begin to normalize.”

In the meantime, our industry will continue to take the good with the bad, finding encouragement in the positive direction in which the economy still seems headed. For example, AHR Expo show management last week enthusiastically reported that 30,678 people had attended its annual event, held earlier this month in Las Vegas after a forced cancellation a year ago. Still, the tally was down 39% from the 50,000 who attended AHR Expo 2020 in Orlando. So, while most metrics may now be trending the right way, they are not yet all the way back to pre-pandemic levels.

Construction employment: 91% recovered

Despite the general economy's strong gains in the latest BLS employment data, the construction industry specifically lost 5,000 jobs in January, logging an unemployment rate of 7.1%. Nevertheless, the industry still has recovered more than one million (91%) of the jobs lost during earlier stages of the pandemic, noted ABC noted.

And this has happened even while hourly pay has climbed at a record pace in the past year, according to an analysis of the BLS date conducted by Associated General Contractors of America (AGC). Average hourly earnings increased 5.1% from January to January, the steepest 12-month increase in the 15-year history of the series, said AGC Chief Economist Ken Simonson.

Since January 2021, the industry has added 163,000 employees despite the decline last month. But the number of unemployed jobseekers among former construction workers shrank by 229,000 over that time, indicating workers are leaving the workforce altogether or taking jobs in other sectors, Simonson added.

The industry average of $33.80 per hour exceeded the private sector average by nearly 7%, he noted. However, competition for workers has intensified as other industries have hiked starting pay and offered working conditions that are not possible in construction, such as flexible hours or work from home.

“Contractors are struggling to fill positions as potential workers opt out of the labor market or choose other industries,” Simonson added. “In addition, soaring materials costs and unpredictable delivery times are delaying projects and holding back employment gains.”

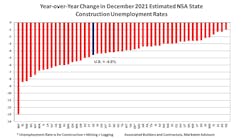

Even so, it is still worth noting that all 50 states ended 2021 with lower construction unemployment rates in December, according to a state-by-state analysis of the BLS data conducted by ABC. The not seasonally adjusted (NSA) national construction unemployment rate plunged 4.6% in December 2021 from a year ago, down from 9.6% to 5%. This substantial improvement occurred even as the omicron COVID-19 variant was sweeping the nation. Year-over-year, 34 states had lower construction unemployment rates, and 16 states were higher.

The Top Five States

The five states with the lowest December 2021 estimated NSA construction unemployment rates were:

- Nebraska, 1.3%

- Indiana and Utah (tie), 1.5%

- Georgia, 1.6%

- Oklahoma, 2%

All five states had their lowest December estimated NSA construction unemployment rate on record.

The Bottom Five States

The states with the highest December 2021 estimated NSA construction unemployment rates were:

- New Jersey, 8.3%

- Michigan, 8.6%

- North Dakota, 9%

- New York, 9.5%

- Alaska*, 10%

*Alaska posted its lowest December estimated NSA construction unemployment rate on record.

##########

“The construction industry is making impressive progress despite continuing supply chain issues, which include extended delivery times and shortages of some building materials and appliances,” said Bernard Markstein, president and chief economist of Markstein Advisors, who conducted the analysis for ABC. “Employers are also coping with difficulties finding skilled workers. The normal winter slowdown in construction activity is, at least temporarily, relieving some of the stress from these challenges.”

National and state unemployment rates are best evaluated on a year-over-year basis because these industry-specific rates are not seasonally adjusted. However, due to the changing impact of the COVID-19 pandemic and related shifts in public policy, month-to-month comparisons offer a better understanding of the pandemic’s effect on construction employment in a rapidly changing economic environment, Markstein explained.

Momentum slows, but trends remain strong

All of the aforementioned factors also caused the Dodge Momentum Index to decline 7% in January to a four-month low of 152.9 (2000=100), from the revised December reading of 163.7. The Momentum Index, issued by Dodge Construction Network (DCN), is a monthly measure of the initial report for nonresidential building projects in planning, which have been shown to lead construction spending for nonresidential buildings by a full year. In January, commercial planning fell 9%, and institutional planning slipped 1%.

"The Dodge Momentum Index had a stellar 2021, rising 23% from 2020 and reaching levels not seen in nearly 14 years," noted Richard Branch, DCN chief economist. "The recent string of declines, however, may be blamed on rising costs, logistical problems and shortages of skilled labor. Still, even as (the index) has decreased, the dollar value of projects in planning remains exceptionally strong, especially for education, warehouse and healthcare projects... Many of the challenges facing construction in 2022 will be similar to those in 2021, dampening expectations for robust growth. However, the volume of projects in planning provides hope not only for a continuing recovery, but for it to be more evenly dispersed than last year."

January 2022 DODGE MOMENTUM INDEX

##########