Construction Jobs Rebound As Delta Surge Loses Steam

Dangerous political brinkmanship on Capitol Hill stole headlines last week, ending temporarily in a two-month solution for raising the federal debt ceiling. But positive news for the U.S. construction industry also arrived, albeit under the radar.

Combined with suddenly improving pandemic trends — new cases have declined 24% nationally since late September — and the increasing likelihood of an honest-to-God federal infrastructure bill this fall, and something approaching optimism seems to be retaking the narrative.

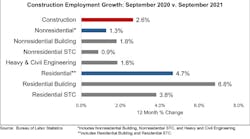

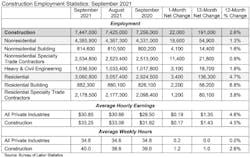

On Oct. 8, the U.S. Bureau of Labor Statistics (BLS) reported that the U.S. economy had added 198,000 jobs in September, including a gain of 22,000 in the construction industry. Even though many analysts had been predicting much higher growth for September, the tally still represents the ninth straight month of positive job numbers since last December's net loss of more than 300,000 jobs. Also, the construction employment data showed that 191,000 jobs had been added over the previous 12 months.

On that note, September also marked the first time in six months that nonresidential construction firms had added employees, according to an analysis of the data by the Associated General Contractors of America (AGC). Nonresidential work continues to be affected by widespread supply chain problems, which are causing owners already uncertain about future demand for commercial space to delay or even cancel some projects, AGC explained.

“While it is refreshing to see job gains in both residential and nonresidential construction, nonresidential building and infrastructure employment remains far below its pre-pandemic peak,” noted AGC Chief Economist Ken Simonson. “It will take more than a few months of gains to match the overall economy.”

Construction employment in September totaled 7,447,000, an increase of 22,000 since August. However, industry employment remained 201,000 below the pre-pandemic peak set in February 2020. The nonresidential segment, comprising nonresidential building and specialty trade contractors plus heavy and civil engineering construction firms, added 18,600 employees in September.

All told, the construction unemployment rate dropped slightly to 4.5% in September. Unemployment across all industries fell from 5.2% in August to 4.8% last month.

“This makes clear that August’s disappointing employment performance was not an aberration,” added Anirban Basu, chief economist at Associated Builders and Contractors (ABC). “The ongoing labor shortage puts continued upward pressure on the price of delivering construction services. Along with input shortages and rising materials prices, this is placing the recovery of nonresidential construction spending at risk."

Simonson also cited the "unending series of supply-chain bottlenecks," as well as extreme price increases and long lead times for a variety of construction materials, as threats to further growth. In fact, more and more project owners are deciding to postpone projects because of excessive increases in both costs and lead times, he said. With that in mind, AGC has again updated its new Construction Inflation Alert, an information guide for owners, building officials, subcontractors and others about the market's continuing cost and supply-chain challenges.

ABC’s own Construction Backlog Indicator confirmed that "a growing chorus of project owners is choosing to delay projects and, in some instances, cancel them altogether." The primary issue is that bids are coming in too high to justify the deployment of capital under many circumstances, explained Basu.

For its part, AGC has urged the Biden Administration to remove tariffs and import quotas on a range of key construction materials to help address supply chain disruptions. They added that Congress can help offset declining nonresidential demand for construction by passing the bipartisan infrastructure bill that has already cleared the Senate.

“Both parties in the House should make passing the infrastructure bill a top priority because it is the best way to create new construction careers and make our economy more efficient,” said AGC CEO Stephen E. Sandherr. “If the President acts to address supply chain problems and Congress passes the infrastructure bill, construction employment is likely to surge.”

Accentuating the Positive

In actuality, despite all the negative factors still hindering the broader economy, more positive evidence is gathering of renewed strength in the recovery, especially in the design and construction sector.

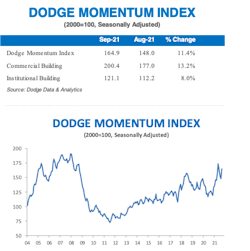

On Oct. 7, the newly named Dodge Construction Network, (formerly Dodge Data & Analytics) released its latest Dodge Momentum Index (DMI) measure of 164.9 (2000=100) for September, a gain of 11% from the revised August reading of 148.0. DMI is a monthly measure of nonresidential building projects in planning, which has been shown to lead construction spending for nonresidential buildings by a full year.

DMI's commercial planning component increased by 13% in September, while the institutional component rose 8%.

"Nonresidential building projects entering planning staged a solid recovery in early 2021, as the economy began to awaken from its pandemic-induced slumber," said Richard Branch, DCN's chief economist. "Entering summer, those gains turned to losses as higher material prices and shortages of labor and goods weighed on the construction sector."

The strength in projects entering planning was widespread during the month, with most sectors moving higher. Excluding healthcare, which experienced a downshift in the dollar value of planning projects in recent months. On a year-over-year basis, the Momentum Index was 30% higher than September 2020; the commercial component was up 32%, while institutional planning was 25% higher.

"The Momentum Index bounced back in September, recording its first monthly increase after three consecutive monthly declines," added Branch. "This is certainly good news and a sign that owners and developers are looking past the current concerns over pricing, Delta, and politics, and are moving forward with projects to meet demand."

He ended with a note of caution, however. "This does not mean there are no problems ahead for the sector," said Branch. "Month-to-month volatility in the data is likely to remain for some time."

Even so, forward-looking design data already has remained consistently positive for some time.

On Sept. 22, the Architecture Billings Index (ABI) recorded its seventh consecutive positive month, according to the latest monthly report from the American Institute of Architects (AIA). The ABI score for August was 55.6, up from July’s score of 54.6. Any score above 50 indicates an increase in billings from the prior month. During August, scoring for both the new project inquiries and design contracts moderated slightly but remained in positive territory, posting scores of 64.7 and 56.6 respectively.

“The surge in design activity continued in August, signifying an expected upturn in construction activity in the fourth quarter and continuing into 2022,” said AIA Chief Economist, Kermit Baker, Hon. AIA, Ph.D. Look for AIA's next update to the index later this month.

"There's a case for optimism in the coming months, assuming the pandemic continues to improve," said Daniel Zhao, a senior economist for job search engine Glassdoor, in an Oct. 8 comment on Twitter.

Indeed, so much hinges on that assumption. But to have the Delta variant now appear to fade nationally — even as schools reopen — does offer considerable hope for the fall, winter, and 2022.

"All in all, there’s a pretty good case that we’ll all be feeling a lot better about life early next year than we are now," wrote Nobel Prize-winning economist Paul Krugman last week. "We didn’t get our summer of joy, but we might be heading for a spring of relief."

##########