PRESS RELEASES

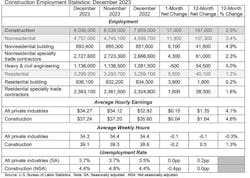

WASHINGTON, Jan. 5, 2024—The construction industry added 17,000 jobs in December, according to the latest data released by the U.S. Bureau of Labor Statistics (BLS). On a year-over-year basis, industry employment grew by 197,000 jobs last year, an increase of 2.5%.

Construction employment in December totaled 8,056,000, seasonally adjusted. The overall gain of 2.5% in our industry outpaced the 1.7% job growth in the overall economy. Residential building and specialty trade contractors added 5,500 employees in December and 40,100 (1.2%) over 12 months. Employment at nonresidential construction firms—nonresidential building and specialty trade contractors along with heavy and civil engineering construction firms—climbed by 11,900 positions for the month and 157,300 (3.4%) since December 2022.

The construction sector also continued to raise wages at a faster clip than other industries, according to the Associated General Contractors of America (AGC), which released its annual 'Contruction Hiring and Business Outlook' members survey on Jan. 4.

“The above-average wages that the construction industry pays have helped contractors add workers,” said AGC Chief Economist Ken Simonson. “More than two-thirds of firms in our survey say they plan to expand in 2024 but they expect it will be as hard or harder to do than it was in 2023.”

According to AGC, the average hourly earnings for production and nonsupervisory employees in construction—covering most onsite craft workers as well as many office workers—climbed by 5.1% over the year to $34.92 per hour. Construction firms in December provided a wage “premium” of nearly 19% compared to the average hourly earnings for all private-sector production employees.

Looking ahead, 69% of the nearly 1,300 firms surveyed said they expect to add to their headcount in 2024, while only 10% expect to reduce headcount. But 55% of respondents, including both union and open-shop employers, expressed concern over their ability to find enough skilled labor.

Simonson noted that contractors will have trouble completing the infrastructure, renewable energy, and advanced manufacturing projects that the Biden Administration is counting on unless they can hire those skilled workers. With that in mind, AGC is urging officials in Washington to reform employment-based immigration policies and boost funding for career and technical education programs that will enable more people to qualify for rewarding jobs in construction.

“Contractors are eager to build the structures that will sustainably improve the nation’s productivity and quality of life,” said AGC CEO Stephen E. Sandherr. “Limiting who can work in construction undercuts the sector’s ability to deliver projects on time and on budget.”

For its part, the rival Associated Builders and Contractors (ABC) open-shop group had its own take on the new employment data.

“Despite strong construction industry employment growth, today’s jobs report was highly contradictory,” said ABC Chief Economist Anirban Basu on Jan. 5. “On one hand, economywide payroll employment expanded faster than expected in December, and the unemployment rate remained unchanged at 3.7%, close to the lowest level in over a half a century. Construction employment increased for the ninth consecutive month, with the nonresidential segment adding jobs at a particularly rapid pace."

“On the other hand, the labor force shrank by 676,000 persons in December, the largest decline since early 2021,” added Basu. “Wage growth also accelerated, with average hourly earnings up 4.1%, year over year, across all industries. That’s faster than expected and a level not consistent with a return to 2% inflation. Construction industry earnings have increased at an even faster rate over the past year."

Of course, other factors should also be remembered. “This is only one month’s data and could contain significant statistical noise,” he notes. “That said, the combination of faster wage growth and a smaller labor force suggests that interest rates could remain higher for longer.”