Even after an election occurs as seemingly momentous as the one the United States just went through this fall, economic forecasting models are still loathe to show any change due to current events.

On the contrary, no matter what, the mathematical input that had been loading all year was still going to shape the highly anticipated annual forecast presented Nov. 14 by the Dodge Construction Network online via a webinar for hundreds of contractors, engineers and architects, etc.

"Over the last year, there's been a lot weighing on us as we try to make decisions in the course of our strategies here," conceded Dodge Chief Economist Richard Branch. "But the outlook for contruction next year is pretty positive."

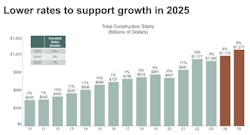

Even before diving into the data, Branch acknowledged that his optimism was already bolstered by the latest decision by the Federal Reserve Board to lower interest rates by another 25 basis points (bps), bringing the Fed's total cuts to 75 points since September. Anticipating even another such cut in December, he wrote on LinkedIn, "As we've looked at past periods of monetary easing and the impact on construction starts it looks like it's going to take close to 125 bps of cuts before we start to see more consistent growth in starts."

Branch said that goal will likely be reached in the First Quarter of 2025 when the Fed makes yet another expected cut. At this point, he expects the Fed will actually lower interest rates by an additional 25 bps in each quarter of next year.

With all those positive signs gathering, Branch delivered a robust forecast for 2025 that foresees a 9% increase in U.S. construction starts, delivering projects valued at $1.27 trillion across the board. This would come after the U.S. finishes 2024 with an expected annual increase of 8%, bringing the market value of those projects up to $1.17 trillion.

Specifically, Dodge expects infrastructure spending to lead the way in 2025, with a 12.9% increase in project starts for roads and bridges. The bipartisan Infrastructure Investment and Jobs Act (IIJA) will continue to fund spending through 2026, "so I think the new Administration won't touch IIJA," said Branch.

The American Council of Engineering Companies concurs. On Nov. 11, ACEC issued this statement: "The Trump Administration will oversee implementation of the last two years of the IIJA, including the allocation of billions in discretionary grants. Emphasis will shift away from grant criteria focused on climate resilience, sustainability, equity and justice considerations with more focus on traditional road and bridge projects."

Aside from infrastructure, the Dodge forecast is also upbeat regarding institutional construction, which includes education and healthcare projects. DCN expects to see 4% growth in that overall category in 2025. Similarly, office construction is also projected to climb 5% next year to a value of $68 billion, Branch said. But, he noted, DCN includes data centers in that category, and when they are removed from the total, traditional office work is expected to decline next year.

"Still, the 100% full remote option for office workers seems to be fewer and far between now, so we're seeing more of an equilibrium now in the hybrid (work) side of the model," Branch added. "We may not need midtown Manhattan anymore, but (firms) may need several regional locations around the country."

Even as "power-hungry" as they are, data center projects will continue to grow. "They are 30-35% of our office category and that share of total is growing aggressively. Whether it is A.I.-related, or cloud, or cybersecurity backup, or national security, these projects are moving through planning and breaking ground quickly," he said.

Dodge projects that data center project starts will grow another 24% in 2025 to hit a total value of $35 billion. And this will come on the heels of a whopping 57% surge in 2024.

Political considerations

Overall, no matter what sort of curveballs the Trump Administration may bring to the market next year, Branch said it is "unlikely" that any policy decisions will have any impact on the contruction market until the second half of 2025.

One caveat, though. The new administration's repeated campaign promises to deport millions of illegal immigrants as soon as possible could be a factor. "One third of the U.S. construction workforce is estimated to be foreign-born, and a large chunk of those are undocumented," noted Branch. "So it remains to be seen how aggressive the new Administration will be."

Similarly, significant policy shifts on labor, trade, taxes and the environment, among other categories, all loom now. And they will affect everything from inflation and the supply chain to jobsite safety and the federal government's regulatory authority and will.

“Heading into 2025, it’s unclear if prices will remain so well-behaved,” said Anirban Basu, chief economist for Associated Builders and Contractors (ABC). “The next administration’s trade policy increases uncertainty regarding construction materials costs. Beyond the implications of potential tariffs, input prices may rise in the short term if purchasers rush to import materials prior to the implementation of those policies. As of October, contractors expected their profit margins to expand through the first quarter of 2025, according to ABC’s Construction Confidence Index. That portion of the index will bear close watching as trade policy shifts in the coming months.”

For its part, ACEC issued an advisory to its engineer members on Nov. 20...

"We are continuing to deconstruct how both the policies and personalities of this new government might affect issues critical to our industry," said ACEC President Linda Bauer Darr. "As to the new Administration, we anticipate Trump 2.0 will bring about broad shifts in the economic and regulatory landscape, particularly environmental regulations."

After reviewing some of the names floated to lead key departments, ACEC reminded members of these considerations and suggested they plan accordingly. This is their brief to members online:

What Else to Consider:

- The incoming administration plans to reverse Biden’s climate policies, including exiting the Paris Accord and halting new offshore wind projects.

- They aim to expedite permits for traditional energy projects and prioritize oil and gas leases.

- Water policy may revert to Trump’s first term policies, redefining WOTUS and potentially revisiting PFAS standards.

- A recent court ruling challenged the White House’s authority over environmental reviews, impacting project delivery and NEPA implementation.

What’s Next:

- Federal agencies might need to create standalone NEPA regulations, which could complicate interagency coordination, stall pending regulatory reviews, and make initiatives to streamline the permitting process, like One Federal Decision, more difficult. Information on how this ruling will affect agencies and the engineering industry is still unfolding, and the ACEC advocacy team will be monitoring developments closely over the coming weeks;

- In the infrastructure space, the next Trump Administration will take charge of implementing the last two years of the IIJA and will need to work with Congress on what comes after the law expires in 2026;

- Much of the unused funding from IIJA is potentially at risk as the new Administration looks to establish its own agenda. But Congress may become the primary driver in developing a new surface transportation program that could become an opportunity for bipartisan cooperation.

Our Take: People Drive Policy

- Regardless of party control, the individuals behind policies shape outcomes.

- This underscores the importance of relationship building and advocacy in Washington and among the states.

- For our part, we’re prepared to be accommodating when it’s possible – and to fight when it’s necessary. That never changes, even when everything else does.

The final portion of this story comes from the ACEC blog The First Word.

#########

About the Author

Rob McManamy

Editor in Chief

An industry reporter and editor since 1987, McManamy joined HPAC Engineering in September 2017, after three years with BuiltWorlds.com, a Chicago-based media startup focused on tech innovation in the built environment. He has been covering design and construction issues for more than 30 years, having started at Engineering News-Record (ENR) in New York, before becoming its Midwest Bureau Chief in 1990. In 1998, McManamy was named Editor-in-Chief of Design-Build magazine, where he served for four years. He subsequently worked as an editor and freelance writer for Building Design + Construction and Public Works magazines.

A native of Bronx, NY, he is a graduate of both the University of Virginia, and The John Marshall Law School in Chicago.

Contact him at [email protected].