Construction Employment Grew in May

From press releases

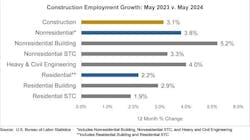

WASHINGTON, June 7— The construction industry added 21,000 jobs in May, according to new data released by the U.S. Bureau of Labor Statistics. On a year-over-year basis, industry employment has increased by 251,000 jobs, an increase of 3.1% since May 2023.

Construction employment in May totaled 8,228,000, seasonally adjusted, up from April. Residential construction firms—homebuilders and specialty trade contractors—added 3,500 employees. The three types of nonresidential contractors added a total of 17,100 employees: 3,000 at nonresidential builders, 13,000 at nonresidential specialty trade contractors, and 1,100 at heavy and civil engineering construction firms.

The construction unemployment rate fell to 3.9% in May. Unemployment across all industries rose from 3.9% in April to 4.0% last month.

“Every monthly employment report is important,” said Anirban Basu, chief economist for Associated Builders and Contractors (ABC). “But this year’s reports are scrutinized carefully for several reasons, including upcoming federal elections. Economists are asking whether indications of softening in certain parts of the economy might cause deterioration in the overall labor market and whether the virtuous cycle of consumer spending and job growth will persist. May’s report indicates that we remain in that virtuous cycle," added Basu.

Associated General Contractors of America (AGC) Chief Economist Ken Simonson concurred. "Construction firms have been adding workers at a faster clip than most sectors,” he noted. “But contractors say they are still having trouble finding enough skilled workers to meet the demand for data centers, manufacturing plants, renewable energy, and infrastructure projects.”

While many would point to larger public infrastructure outlays as an obvious source of strength, the new report indicates job growth across many industry segments, said Basu. The rapid transformation of the U.S. economy continues to more than offset the negative impacts of elevated project financing costs, he added.

“Despite perpetual fears of recession and the dislocating impacts of high borrowing costs, the U.S. nonresidential construction industry is adding jobs rapidly and will continue to, according to ABC’s Contractor Confidence Index,” said Basu.

According to AGC, average hourly earnings for production and nonsupervisory employees in construction—covering most onsite craft workers as well as many office workers—climbed by 4.3% over the year to $35.45 per hour. Construction firms in April provided a wage “premium” of 18.2% compared to the $29.99 average hourly earnings for all private-sector production employees.

AGC officials said nonresidential contractors are still having difficulty finding enough workers to execute projects on time. They urged government officials at all levels to put more resources into education and training programs for fields like construction. They also called again on Congress and the Biden administration to allow construction firms to sponsor qualified foreign workers to ease critical shortages of skilled crafts.

For its part, ABC remains worried about inflation and unemployment.

“As always, the news was not purely positive,” said Basu. “Wage pressures picked up in May, likely quashing hopes for a Federal Reserve rate cut in July. While the establishment survey indicated that the nation added 272,000 jobs in May on a seasonally adjusted basis, blowing through consensus expectations, the household survey indicated that the nation’s unemployment rate increased despite a shrinking U.S. labor force. What that means is that the headline job growth number emerging from the establishment survey may be overstating U.S. economic strength while also delaying the Federal Reserve’s response to potentially emerging economic weakness.”

#####