By ERIKA WALTER, Associated Builders and Contractors

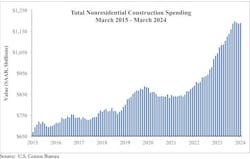

WASHINGTON, May 1, 2024 —National nonresidential construction spending increased 0.2% in March, according to an Associated Builders and Contractors (ABC) analysis of data published today by the U.S. Census Bureau. On a seasonally adjusted annualized basis, nonresidential spending totaled $1.19 trillion.

Spending was up on a monthly basis in 10 of the 16 nonresidential subcategories. Private nonresidential spending decreased 0.2%, while public nonresidential construction spending was up 0.8% in March.

“Nonresidential construction spending rebounded in March, ending a streak of two straight monthly declines,” said ABC Chief Economist Anirban Basu. “The increase was entirely due to increased public construction spending; private sector nonresidential spending dipped slightly lower in March. Despite wavering over the first three months of 2024, nonresidential spending is now up approximately 35% from the start of the pandemic and has outpaced economywide inflation (+20%) over that span. Ongoing spending strength, driven by both the public sector and the ascendant manufacturing category, continues to support healthy backlog for contractors, according to ABC’s Construction Backlog Indicator.”

New Job Openings Data Drops

Meanwhile, according to the latest U.S. Bureau of Labor Statistics’ Job Openings and Labor Turnover Survey (JOLTS), also released May 1, the construction industry had 274,000 job openings on the last day of March. JOLTS defines a job opening as any unfilled position for which an employer is actively recruiting. Industry job openings decreased by 182,000 last month and are down by 17,000 from the same time last year.

“Construction job openings plunged in March, falling to the lowest level since October 2020,” noted Basu. “While there are many headwinds facing the industry, including the prospect of higher-for-longer interest rates, this dismal number likely reflects a statistical aberration rather than a legitimate decline in demand. We know that the construction industry added jobs at a rapid pace in March, and both backlog and contractor confidence improved for the month, according to ABC's Construction Backlog Indicator and Construction Confidence Index, respectively.

“We have seen this kind of volatility in the JOLTS data before; construction job openings also plunged last March,” he added. "Which is to say, on a year-over-year basis, openings are only down modestly. The sizable decline in openings observed in March 2023 and 2024 may reflect seasonal hiring patterns that are not reflected in the BLS’s seasonal adjustment factors. Accordingly, these data should not be viewed as a sign of an industry slowdown, at least not without another month or two of data to corroborate it.”

##########

About the Author

Erika Walter

Based in Baton Rouge LA, Erika Walter is director of media relations at Associated Builders and Contractors (ABC), a national construction industry trade association, headquartered in Washington DC. She can be reached at (202) 905-2104 | [email protected].

Established in 1950, ABC today represents more than 23,000 members. Founded on the merit shop philosophy, ABC and its 68 chapters help members develop people, win work and deliver that work safely, ethically and profitably for the betterment of the communities in which ABC and its members work. For more, visit abc.org.

Also, visit abc.org/economics for the Construction Backlog Indicator and Construction Confidence Index, plus analysis of spending, employment, job openings and the Producer Price Index.