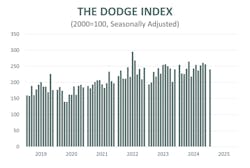

Dodge: Construction Starts Fell 6% in January

PRESS RELEASE

BOSTON, MA — February 21, 2025 — Total construction starts fell 6% in January to a seasonally adjusted annual rate of $1.1 trillion, according to Dodge Construction Network. Nonresidential building starts receded 18%, residential starts decreased 1%, while nonbuilding starts moved 4% higher.

On a year-over-year basis, total construction starts were down 6% from January 2024. Nonresidential starts were down 22%, residential starts were down 2% and nonbuilding starts were up by 17% over the same period.

For the 12 months ending January 2025, total construction starts were up 4% from the 12 months ending January 2024. Residential starts were up 5%, nonresidential starts were flat, and nonbuilding starts rose 7% over the same period.

“After robust data center starts in November and December, total office starts fell back in January to more historically typical levels and drove a sizable piece of the month-to-month decline,” stated Sarah Martin, associate director of forecasting at Dodge Construction Network. “However, most nonresidential sectors saw weakness over the month. Ongoing labor shortages and high material costs will continue to pose risks to the sector, along with concerns over tariffs and stricter immigration enforcement. Projects are likely to continue moving through the planning queue slowly, until the Federal Reserve resumes cutting rates in the back half of the year.”

Nonbuilding

Nonbuilding construction improved 4% in January to a seasonally adjusted annual rate of $337 billion. Highway and bridge starts rose 14%, miscellaneous nonbuilding starts were up 26%, and utility/gas starts improved 1% over the month. Meanwhile, environmental public works fell 14%. On a year-over-year basis, nonbuilding starts were up 17% – with utility/gas starts up 84%, miscellaneous nonbuilding up 25%, highway and bridge starts up 10%, and environmental public work starts flat compared to January 2024.

For the 12 months ending January 2025, total nonbuilding starts were up 7%.

Miscellaneous nonbuilding starts led the way, improving 26% compared to the 12 months ending January 2024. Environmental public works were up 21%, highway and bridge starts were up 5%, and utility/gas starts were down 11% over the same period.

The largest nonbuilding projects to break ground in January were the $1.1 billion Sequoia Solar Farm (815 MW) in Callahan County, Texas, the $696 million NHHIP Segment 3B-2 road widening project in Houston, Texas and phase two of the Beaver Stadium renovations, valued at $630 million, in University Park, Pennsylvania.

Nonresidential

Nonresidential building starts receded 18% in January to a seasonally adjusted annual rate of $393 billion. Commercial starts were 41% lower in January, alongside weak office and hotel starts. Institutional starts, on the other hand, were up 4% in January following growth in healthcare and recreational projects. Manufacturing starts fell 16% over the month. On a year-over-year basis, nonresidential starts are down 22% compared to January 2024. Commercial starts are down 18% and institutional starts are down 1% over the same period.

For the 12 months ending January 2025, total nonresidential starts were flat compared to the 12 months ending January 2024. Commercial starts were up 7%, institutional starts improved 13%, and manufacturing starts were down 45% over the same period.

The largest nonresidential building projects to break ground in January were the $5 billion Children’s Health & UTSW New Pediatric Campus in Dallas, Texas, the $333 million Mid-Hudson Forensic Psychiatric Hospital in New Hamptom, New York and the $307 million Timber Mill High School and Athletic Field in Conroe, Texas.

Residential

Residential building starts fell 1% in January to a seasonally adjusted annual rate of $407 billion. Single-family starts fell 2%, while multifamily starts improved 2%. On a year-over-year basis, residential starts are down 2% compared to January 2024, with single–family starts up 6% and multifamily starts down 15%.

For the 12 months ending January 2025, total residential starts were up 5%, while single-family starts were up 14%, and multifamily starts were down 10% compared to the 12 months ending January 2024.

The largest multifamily structures to break ground in January were the $470 million Ulana Ward Village Tower Building in Honolulu, Hawaii, the $400 million JEM residences at Miami World Center in Miami, Florida, and the $279 million Alafia Affordable Apartments in Spring Creek, New York.

Regionally, total construction starts in January rose in the Northeast and South Central, but fell in the Midwest, South Atlantic, and West.

###

About Dodge Construction Network

Dodge Construction Network harnesses data, analytics, and industry connections to be the leading source of insights and opportunities in the commercial construction industry. With five trusted solutions-Dodge Construction Central, The Blue Book, Sweets, IMS, and Principia-Dodge connects construction professionals across all stages of the building process. Designed for both small teams and large enterprises, these tools simplify complexity, empowering you to build thriving businesses and communities. With over a century of experience, Dodge Construction Network is the catalyst for modern construction. To learn more, visit construction.com.

Media Contact:

| [email protected]