Construction Starts Jumped 10% in July

PRESS RELEASE

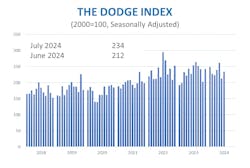

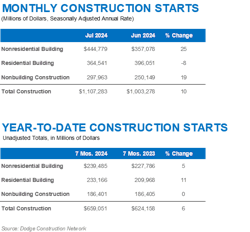

BEDFORD, MA —August 22, 2024 — Total construction starts moved 10% higher in July to a seasonally adjusted annual rate of $1.1 trillion, according to Dodge Construction Network. Nonresidential buildings and infrastructure starts performed strongly during the month, countering a decline in residential starts.

During the month, nonresidential buildings rose 25% and infrastructure starts increased by 19%. Residential starts fell 8% during the month. On a year-to-date basis through July, total construction starts were up 6% from the first seven months of 2023. Residential starts were up 11%, nonresidential buildings rose 5%, and nonbuilding starts were flat.

For the 12 months ending July 2024, total construction starts were up 3% from the 12 months ending July 2023. Nonresidential building starts were down 1%, residential starts were up 7%, and nonbuilding starts were up 5% on a 12-month rolling sum basis.

“Construction starts showed great promise in July,” said Richard Branch, chief economist of Dodge Construction Network. “However, the short-term remains questionable due to high interest rates. The Federal Reserve is likely to cut interest rates in September, which will, over time, make market conditions more conducive to moving projects forward. In the meantime, construction starts will likely remain volatile over the next few months.”

Nonbuilding

Nonbuilding construction starts rose 19% from June to July to a seasonally adjusted annual rate of $298 billion. All sectors increased during the month, with utility/gas starts rebounding from a weak June and more than doubling in July. Highway and bridge starts rose 11%, environmental public works gained 8%, and miscellaneous nonbuilding starts were 1% higher.

On a year-to-date basis through July total nonbuilding starts were flat from a year ago. Environmental public works starts were 12% higher, miscellaneous nonbuilding starts rose 5%, highway and bridge starts were 3% higher, but utility/gas starts were down 16% through July.

For the 12 months ending July 2024, total nonbuilding starts were 5% higher than the 12 months ending July 2023. Utility/gas starts were up 10%, environmental public works starts improved 6%, while highway and bridge starts and miscellaneous nonbuilding starts were each 2% higher for the 12 months ending July 2024.

The largest nonbuilding projects to break ground in July were the $1.5 billion Revolution Wind offshore wind farm off the coast of Rhode Island, the $819 million Potomac River Tunnel in Washington, DC, and the $800 million Ryan Field Stadium at Northwestern University in Evanston, Illinois.

Nonresidential

Nonresidential building starts improved 25% in July to a seasonally adjusted annual rate of $445 billion. Manufacturing starts improved 33%, while commercial starts rose 30% due to increases in data center and hotel starts. Institutional starts gained 18% in July mostly due to a sharp increase in healthcare starts. On a year-to-date basis through July, total nonresidential starts were up 5%. Institutional starts were 13% higher, while commercial starts were up 3%, and manufacturing starts were 12% lower on a year-to-date basis through July.

For the 12 months ending July 2024, nonresidential building starts were 1% lower than the previous 12 months. Manufacturing starts were down 19% and commercial starts were down 5%, while institutional starts were 10% higher for the 12 months ending July 2024.

The largest nonresidential building projects to break ground in July were the $2.1 billion Novo Nordisk plant in Clayton, North Carolina, the $1.6 billion first phase of the AWS Amazon data center in Canton, Mississippi, and the $800 million Meta data center in Montgomery, Alabama.

Residential

Residential building starts lost 8% in July, falling to a seasonally adjusted annual rate of $365 billion. Single family starts shed 13% in the month, while multifamily starts rose 3%. On a year-to-date basis through seven months, total residential starts were 11% higher. Single family starts improved 22% and multifamily starts were 8% lower on a year-to-date basis.

For the 12 months ending July 2024, residential starts were 7% higher than the previous 12 months. Single family starts were 17% higher, while multifamily starts were 9% lower on a 12-month rolling sum basis.

The largest multifamily structures to break ground in July were the $300 million Music Row Albion apartment towers in Nashville, Tennessee, the $254 million Commodore Perry apartments in Buffalo, New York, and the $250 million One Tampa condominiums in Tampa, Florida.

Regionally, total construction starts in July rose in all regions.

##########

###

About Dodge Construction Network

Dodge Construction Network is a solutions technology company providing an unmatched offering of data, analytics, and industry-spanning relationships to generate the most powerful source of information, knowledge, insights, and connections in the commercial construction industry. The company powers longstanding and trusted industry solutions to timely connect and enable decision makers across the entire commercial construction ecosystem. For more than a century, Dodge Construction Network has empowered construction professionals with the information they need to build successful, growing businesses. To learn more, visit construction.com.

Media Contact:

| [email protected]