Construction Spending Slipped, Job Openings Rose in May

From press releases

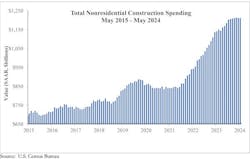

WASHINGTON, July 2—National nonresidential construction spending decreased 0.1% in May, according to an Associated Builders and Contractors (ABC) analysis of data published today by the U.S. Census Bureau. On a seasonally adjusted annualized basis, nonresidential spending totaled $1.21 trillion.

Meanwhile, the construction industry also reported 339,000 job openings on the last day of May, according to the U.S. Bureau of Labor Statistics’ Job Openings and Labor Turnover Survey. JOLTS defines a job opening as any unfilled position for which an employer is actively recruiting. Industry job openings increased by 2,000 in May but are down by 38,000 from the same time last year.

"While the number of open, unfilled construction positions has declined over the past year, the industry is still faced with widespread labor shortages,” said ABC Chief Economist Anirban Basu. “The 4% of construction jobs that were unfilled in May is a higher rate than in the months leading up to the start of pandemic, a time when construction labor was already scarce."

Because of these shortages, a higher share of construction workers quit in May than in any month over the past year.

“Over half of contractors intend to increase their staffing levels during the next six months, according to ABC’s Construction Confidence Index,” said Basu. “As a result of this ongoing intention to hire and the lack of available workers, contractors laid off just 1.8% of the workforce in May, a smaller share than in any month on record prior to late 2021.”

Returning t0 spending, that measure in May declined on a monthly basis in 9 of the 16 nonresidential subcategories. Private nonresidential spending decreased 0.3%, while public nonresidential construction spending was up 0.4% in May.

“Nonresidential construction spending has fallen for two consecutive months yet remains just 0.2% below the all-time high achieved in March 2024,” noted Basu. “Much of that progress is attributable to ongoing infrastructure investments."

“Private nonresidential spending has lagged,” he added. “That weakness can be tied to interest rate-sensitive segments like office and commercial, both of which have also been hampered by altered demand dynamics in the wake of the pandemic. Despite this recent private sector moderation, contractors remain confident about the next few quarters, with a majority expecting their sales to increase over the next six months, according to ABC’s Construction Confidence Index.”

For more, contact Erika Walter, ABC | (202) 905-2104 | [email protected].

About the Author

Erika Walter

Based in Baton Rouge LA, Erika Walter is director of media relations at Associated Builders and Contractors (ABC), a national construction industry trade association, headquartered in Washington DC. She can be reached at (202) 905-2104 | [email protected].

Established in 1950, ABC today represents more than 23,000 members. Founded on the merit shop philosophy, ABC and its 68 chapters help members develop people, win work and deliver that work safely, ethically and profitably for the betterment of the communities in which ABC and its members work. For more, visit abc.org.

Also, visit abc.org/economics for the Construction Backlog Indicator and Construction Confidence Index, plus analysis of spending, employment, job openings and the Producer Price Index.