Over the last 10 years, the mechanical-engineering and construction industry has rapidly adopted building information modeling (BIM), an intelligent, model-based process providing insight for faster, more economical, and less environmentally impactful development and management of building and infrastructure projects. According to a McGraw-Hill Construction report,1 BIM adoption among architecture, engineering, and construction (AEC) firms rose from 17 percent in 2007 to 71 percent in 2012. Where BIM goes from here will be determined by three key technological movements that are redefining the way mechanical engineers and contractors work: digital infrastructure, big data, and emerging markets.

Digital Infrastructure

Digital infrastructure has evolved considerably over the last two decades. Take the fax machine. Once, it had a place in every business; today, it rarely is seen. Digital infrastructure evolved to newer methods of communication—e-mail and mobile and social communication mechanisms—that are quicker, are more efficient, and allow greater productivity and reduced overhead. The landscape is set to change once again.

Technology that allows us to store large files for access anywhere anytime—such as superfast broadband, 4G LTE, and cloud services—is changing the way we work. One Internet Goliath is piloting a service offering 1,000-MB-per-second download speeds and a terabyte of cloud storage.

John Mack, BIM manager for San Francisco-based Herrero Builders, recently spoke about the industry’s reliance on connectivity and what it might mean for the future.

“The industry is already pushing models to the threshold of current desktop technology,” Mack said. “At times, I am crashing the best machine I can buy. As data explodes, the cloud is going to be the most financially viable option for the mechanical-engineering and construction industry. This is most certainly enabled by the fact that upload and download speeds are constantly improving on a rapid scale.”

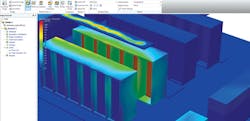

The cloud makes available virtually unlimited computing power; mechanical engineers are harnessing this power for such computationally heavy tasks as air and fluid flow and thermal-comfort simulation. The cloud also provides key financial benefits related to information-technology infrastructure.

“Moving my files and potentially my software products to the cloud means I can buy less-expensive computers, which is a huge hardware-cost advantage,” Mack said. “I’m no longer buying expensive servers or the knowledge to run those servers.”

According to a recent white paper,2 monthly mobile data traffic grew to 885 PB—a year-over-year increase of 70 percent—in 2012 and is expected to surpass 10 EB (1 trillion GB) in 2017. New mobile devices, combined with speedier access to data in the cloud, are poised to change the face of the mechanical-engineering and contracting industries (see “Contractor Smartphone Use Up 35 Percent”).

David Pikey, BIM implementation director for Franklin Park, Ill.-based The Hill Group, initially was skeptical about the use of mobile devices on the job.

“I’m a technology person,” Pikey said. “It’s my job. ... But when iPads were introduced, I didn’t see how they could apply outside of entertainment. Today, my opinion of these devices has completely changed. I think they are going to be a big deal and change the way we design, construct, and manage buildings.

“In construction,” Pikey continued, “you are dealing with a broad cross section of technical skills. Mechanical design firms and construction firms are steeped in software, processes, and ways of working that don’t necessarily translate to building operators. Mobile technology and apps on those devices will quickly evolve to revolutionize building management and, as a result, how engineers and contractors deliver their final product.”

Big Data

The evolution of digital infrastructure, including the proliferation of cloud computing and mobile devices, enables and strengthens another change affecting mechanical engineers and contractors: big data.

According to IBM, 90 percent of the data in the world today was created over the last two years, and every day, 2.5 quintillion bytes of new data is created.3

“We are just getting too much data,” Mack said. “And the demand for data will continue to increase as buildings become more intelligent.”

The laws of economics tell us demand must be met by supply. The demand for increasing amounts of data in building models is going to change the responsibilities of mechanical designers, engineers, and contractors in the long run.

“Engineers and contractors build—we are great at building,” Pikey said. “But after we’ve turned the building over and have moved on to a new project, what happens on the old project doesn’t really affect us. As technology evolves and the demand for data increases, our industry is going to have to address that, and we are going to need to understand the entire life cycle of a building.”

The level of detail and amount of data needed in a building information model is a source of debate within the industry. The expansion of hosted storage and sharing, increases in download and upload speeds, and the computing force of cloud services will ease concerns about the manageability of large models.

Emerging Markets

According to a 2011 report,4 global construction will increase by nearly 70 percent to $12 trillion by 2020, when 55 percent of global construction will be in emerging markets.

“Building in emerging markets is different,” Pikey said. “On some projects in some countries, when you need to increase productivity or throughput, adding staff makes more financial sense than investing in technology. That’s going to change as GDP (gross domestic product) and cost of living improves.”

Lee Kopsaftis, director of architecture and engineering (AE) service for Eatontown, N.J.-based DLB Associates, said his firm sees “massive potential” in Asia and South America.

“Rather than sitting on the sidelines, we are proactively building relationships and monitoring trends in emerging markets,” Kopsaftis said. “The integration of BIM software has significantly increased our ability to improve communication through visualization. Using photorealistic renderings and video-quality walkthroughs has enabled us to tell a compelling story regardless of any language barriers. Cutting-edge technology and powerful communication strategies allow real-time visual communication between clients and DLB’s core AE group, regardless of location.”

With this opportunity, however, comes the possibility of increased competition. With their infrastructure networks still being developed, emerging markets have the advantage of leapfrogging technology developed markets perfected, but need to shift away from. For example, while developed markets iron out complexities of BIM and cloud computing and storage, emerging markets can watch and learn, avoiding the developed markets’ growing pains and becoming proficient more quickly.

Conclusion

Sometimes, envisioning what exactly a paradigm shift will mean to an industry can be difficult. This particularly is the case with construction.

“Construction is a lagging indicator in a number of indexes, and we’ve not yet fully absorbed what I call the BlackBerry revolution,” Pikey said.

But change is happening:

• Revolutionary processes. Rapid advancements in digital infrastructure and cloud computing and increased use of mobile devices have set the stage for upheavals in workflows and processes related to the design, fabrication, installation, and operation of mechanical systems for new buildings. Designers will engineer better systems using computationally heavy cloud simulation that previously was too cumbersome to conduct on a desktop computer and accelerate cross-disciplinary clash detection, coordination, and collaboration through cloud storage, sharing, and services. Mechanical contractors will improve fabrication and installation processes for just-in-time delivery, field management, commissioning, and handover using mobile devices.

• More data and more responsibility. As building owners pursue the construction of intelligent buildings for more accurate reporting and regulation of performance, they will require smarter building models that better support facility management and operations (see “New Book: ‘BIM for Facility Managers’”). This will require designers, engineers, and contractors to shoulder more responsibility for commissioning data and utilize infrastructure that can support the weight of a model with speed of access that is efficient for the end-user.

“We are looking at a future where a maintenance work log is generated ahead of time based on the intelligence of the as-built model,” Mack said. “This future model contains all this maintenance information and even syncs real-time meter and sensor data, enabling the equipment to automatically alert you when it is not working correctly.”

• Greater competition, but also opportunity. To gain or maintain a competitive advantage, businesses need to address emerging markets and the potential—for new business, as well as competition—they hold.

“Becoming BIM-capable and technologically savvy is more than just buying something,” Pikey concluded. “You have to have your people work through, understand, and tailor themselves to a new world. AEC firms need to look at mobile, cloud, and data now to start preparing themselves for the inevitable.”

References

1) McGraw-Hill Construction. (2012). The business value of BIM in North America: Multi-year trend analysis and user ratings (2007-2012). Bedford, MA: McGraw-Hill Construction. Available at http://images.autodesk.com/adsk/files/mhc_business_value_of_bim_in_north_america_2007-2012_smr.pdf

2) Cisco. (2013). Cisco visual networking index: Global mobile data traffic forecast update, 2012–2017. San Jose, CA: Cisco Systems. Available at http://www.cisco.com/en/US/solutions/collateral/ns341/ns525/ns537/ns705/ns827/white_paper_c11-520862.pdf

3) IBM. (n.d.). What is big data? Retrieved from http://www-01.ibm.com/software/data/bigdata/

4) Global Construction Perspectives & Oxford Economics. (2011). Global construction 2020: A global forecast for the construction industry over the next decade to 2020. London: Global Construction Perspectives. Available for purchase at http://www.globalconstruction2020.com

An industry marketing manager for Autodesk Inc., Sam Robins is responsible for marketing strategy and execution for several of Autodesk’s products for the architecture, engineering, and construction industry.

Did you find this article useful? Send comments and suggestions to Executive Editor Scott Arnold at [email protected].