Imagine for a moment what it must be like to be Jerome Hayden Powell.

At 70, the 16th chairman of the Federal Reserve Bank has now been in that ultimate 'influencer' perch since 2018. In that time, he has seen the world economy shaken to its core by a global pandemic and a still-unresolved war in Europe, as well as extraordinary political divisiveness and even societal instability here in the U.S.

So now, as recovering international markets still struggle to exhale amid constant fears of recession, every time Powell steps to a podium and even clears his throat, he knows the whole world is watching. Market analysts everywhere are reading every tea leaf to see if additional actions by the Fed to curb inflation will finally trigger a global economic downturn.

Just imagine that pressure.

Is it any wonder then that Chairman Powell prefers to remain vague, as he did again August 25, when he took the stage at the Fed's annual symposium in Jackson Hole, WY:

We are navigating by the stars under cloudy skies. In such circumstances, risk-management considerations are critical. At upcoming meetings, we will assess our progress based on the totality of the data and the evolving outlook and risks. Based on this assessment, we will proceed carefully as we decide whether to tighten further or, instead, to hold the policy rate constant and await further data. Restoring price stability is essential to achieving both sides of our dual mandate. We will need price stability to achieve a sustained period of strong labor market conditions that benefit all... We will keep at it until the job is done.

That job for the last 17 months has been to bring the U.S. core inflation rate down to 2.0%. So, since March 2022, the Fed has raised interest rates 11 times, from near zero to 5.5% in July 2023. As a result, inflation has dropped from a post-pandemic high of 8.5% early last year to 3.2% this summer. Despite that relatively rapid progress, however, most still expect the Fed to raise interest rates again in September, still aiming for that 2% target.

Remarkable resilience, persistent stability

Even with all of the Fed's aggressive anti-inflationary measures, ostensibly aimed at cooling down the U.S. economy to keep it from "overheating," design and construction activity has remained remarkably determined to make up for lost time and opportunity stolen by the pandemic.

Buoyed by unprecedented federal stimulus, led by massive infrastructure investment funded by last summer's Inflation Reduction Act, our industry may well be the main reason a long-predicted recession has yet to materialize.

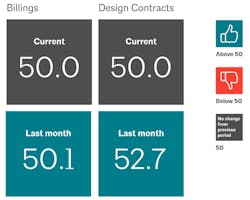

On Aug. 23, the American Institute of Architects (AIA) released its latest Architecture Billings Index (ABI) results for July, again reflecting mostly stable business conditions for survey participants. The ABI score stood at 50.0, indicating that billings remained flat for the month.

“This is the third straight month that billings at architecture firms have stabilized,” said AIA Chief Economist Kermit Baker, PhD. “New project work has been even stronger over this period. This suggests that design work may finally begin to increase over the coming months, although somewhat modestly.”

Of particular note, firms with a commercial/industrial specialization reported their strongest billings growth in more than a year. In particular, industrial and manufacturing construction has been a particular strength of the post-pandemic recovery.

On Aug. 23, that market was also singled out in a new report by the White House Council of Economic Advisers, (CEA) which touted a "reinvigoration of America’s manufacturing sector—especially in sectors like semiconductors and clean energy technologies." Comparing U.S. investment to several other nations, CEA added, "The sheer scale and pace of America’s manufacturing construction uptick is unique compared to similar indicators from other advanced countries like Germany, Japan, Australia, and the United Kingdom." (See CEA Figure 1.)

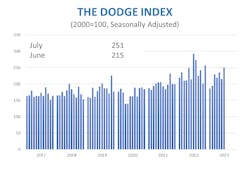

For the 12 months ending July 2023, industrial and manufacturing starts were up 24%, according to the latest monthly data from Dodge Construction Network. In particular, numbers for July jumped with the start of a $12-billion LNG facility in Brownsville TX. At the same time, work broke ground on a new $405-million, Envision AESC, BMW components manufacturing plant in Florence, SC.

Overall, Dodge reports that total construction starts rose 17% in July to a seasonally adjusted annual rate of $1.2 trillion. Nonbuilding starts drove the increase, rising 38%, due mostly to the start of the mammoth LNG facility. Residential starts rose 20%, while nonresidential building starts fell 6%.

Year-to-date through July 2023, total construction starts were 7% below that of 2022. For the 12 months ending July 2023, however, total starts were 3% higher than that of 2022.

“Construction starts have plateaued and are making little headway,” said Dodge Chief Economist Richard Branch. “Higher interest rates, labor shortages and material prices continue to impact the flow of construction starts — resulting in little forward momentum over the last 12 months. The lag in nonresidential building projects entering the planning stage will slow starts as the year progresses, which should be offset by rising infrastructure activity.”

"Rising infrastructure activity"

That bump in infrastructure projects has continued to sustain and extend the post-pandemic recovery. And the numbers that best reflect that may be in U.S. construction employment.

On Aug. 18, the Bureau of Labor Statistics reported its latest monthly data, which showed that July construction hiring had increased in 45 states and the District of Columbia from a year earlier. Month-to-month, 27 states added construction employees from June to July, according to an analysis of the new federal employment data released by the Associated General Contractors of America.

“Construction job gains were nearly ubiquitous over the past year,” said AGC Chief Economist Ken Simonson. “While barely half the states added construction employees in July, that is due to the sector’s ultra-low unemployment rate. There is still plenty of demand, as shown by near-record construction job openings.”

On the design side (based on June data), AIA's Baker noted that "architectural services employment continued to grow as well." In particular, an additional 1,100 new positions were added in the U.S in June. "Through the first six months of the year, the industry has added a total of 3,600 new positions," he said.

Meanwhile, industry backlogs continue to increase, according to Associated Builders and Contractors (ABC). Its latest Construction Backlog Indicator (CBI) increased to 9.3 months in July, according to an ABC member survey conducted July 20 to Aug. 4. The reading is up by 0.6 months since July 2022. Taken together, that steadiness represents another good sign for our industry and its ability to soften the blow of the inevitable next downturn, whenever it does finally arrive.

##########