Still hiring? Still busy? Well, you're not alone.

As we near the end of 2023's first quarter, the U.S. economy's widely expected recession still has not quite arrived, despite months of dire predictions from many economists. In fact, in early March, Credit Suisse Chief Economist Ray Farris coined a new term, evoking Samuel Beckett's famed play about a title character who never actually shows up.

“It’s the ‘Godot recession',” Farris told The Wall Street Journal, referencing Waiting for Godot. Every six months, economists have predicted a recession six months later, he said. “By the middle of the year, people will still be expecting a recession in six months’ time.”

For the moment, however, even as the Federal Reserve continues to raise interest rates in its long, but only partly successful, effort to curb inflation, the U.S. construction industry still bulls forward. And the work is continuing at such a pace that worker shortages remain among the chief concerns for AEC firms also wrestling with the supply chain and the lingering effects of the pandemic. In fact, initial market setbacks earlier in the year already appear to be correcting themselves.

On March 7, the Dodge Construction Network (DCN) reported that its monthly Dodge Momentum Index (DMI) advanced 1.9% in February to 203.0 (2000=100) from a revised January reading of 199.3. In February, the commercial component of the DMI rose 1.4%, and the institutional component increased 2.9%.

“The Dodge Momentum Index returned to growth in February after falling 9% last month,” stated Sarah Martin, DCN's associate director of forecasting. “The continued elevation in the DMI should provide hope that construction activity will grow in 2024."

Owners and developers tend to put projects into planning until well after economic conditions weaken, she explained. During the Great Recession, for example, the DMI did not substantially decline until 2009. "Therefore, the anticipated mild economic growth in 2023 could cause the DMI to moderate over the year, but it is unlikely to fall below historical norms,” Martin added.

Commercial planning in February was bolstered by almost 20% growth in office planning activity, as data centers continued to steadily enter the planning phase, according to Dodge.

Institutional planning was driven higher by growth in education and healthcare projects, notably the continued investment in research laboratories. On a year-over-year basis, the DMI remains 43% higher than in February 2022. The commercial component was up 55%, and the institutional component was 22% higher, Martin noted.

Construction employment, wages climb

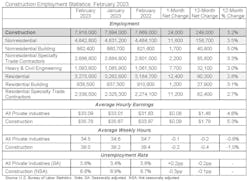

Not surprisingly, construction employment data showed considerable strength in February, as well.

According to the latest numbers from the U.S. Bureau of Labor Statistics, released March 10, the construction industry added 24,000 jobs in February. On a year-over-year basis, industry employment has risen by 249,000 jobs, an increase of 3.2%.

Nonresidential construction employment increased by 11,600 positions, with growth registered in all three subcategories. Heavy and civil engineering added 7,700 net new jobs, while nonresidential specialty trade added 2,200 positions. The number of nonresidential building jobs increased by 1,700. Overall, the U.S. construction unemployment rate fell to 6.6% in February, down from 6.9% in January.

Unemployment across all industries rose from 3.4% in January to 3.6% last month.

“Both residential and nonresidential contractors added jobs in February, which is consistent with ABC’s Construction Confidence Index, indicating that many contractors continue to seek additional staffing," said Associated Builders and Contractors' Chief Economist Anirban Basu. “While industry momentum persists, the jobs report suggests that the Federal Reserve still has considerably more work to do to slow the economy. Though average hourly earnings are not expanding as quickly as they had been, wages are still rising too rapidly on an annual basis to position the Federal Reserve to restore inflation to its 2% target. Accordingly, monetary policy is set to tighten more quickly going forward, with interest rates rising further and staying higher for longer."

For its part, the Associated General Contractors of America (AGC) argues that it is our industry's higher wages that have allowed it to outpace other industries in the rate of hiring.

"Hefty pay raises for hourly workers enabled the (construction) industry to increase employment more steeply than other sectors," said AGC Chief Economist Ken Simonson. Still, while employment levels are now at record levels, future job gains will be hard given the lack of people who have been exposed to construction career opportunities, he added.

“Average hourly earnings for craft and office workers in construction have consistently risen more sharply than across the private sector as a whole for several months,” explained Simonson. “That has helped the industry add employees at a strong clip — but many more are still needed.”

Construction employment totaled a record 7,918,000, seasonally adjusted, in February, an increase of 249,000 or 3.2% from a year earlier. That growth rate exceeded the 2.9% rise in total nonfarm employment.

Nonresidential firms—comprising nonresidential building and specialty trade contractors along with heavy and civil engineering construction firms—added 11,600 employees in February and 158,700 employees or 3.5% over 12 months. Residential building and specialty trade contractors together added 12,400 employees for the month and 90,300 employees, or 2.8% over the year.

Pay levels in the construction industry climbed in February at a faster pace than in the overall private sector for the sixth-straight month. Average hourly earnings for production and nonsupervisory workers in construction—mostly hourly craft workers—rose by 6.1%, from $31.63 in February 2022 to $33.57 last month. That increase topped the 5.3% rise in average pay for all private sector production workers. Workers in construction now earn an average of 18.1% more per hour than in the overall private sector.

AGC officials said that while firms have had success recruiting workers by offering higher pay levels, the pool of qualified workers remains tight. They noted that relatively few new workers are exposed to construction while in school, which is a consequence of meager federal funding for career and technical education. They urged the Biden Administration to boost funding for construction education programs.

“Construction firms are doing everything they can to bring in new workers to keep pace with demand,” said AGC CEO Stephen E. Sandherr. “But it is hard to recruit workers who have never been exposed to the industry and don’t appreciate the amazing pay, benefits and satisfaction that comes with a career in construction.”

The Fed v. Inflation

Even so, the persistent fear of economic recession lingers, and try as I might, I cannot unhear the ominous words from Dodge Chief Economist Richard Branch in his annual forecast last November. Noting the Fed's determination to bring core inflation down to 2% nationally, he said, "The Federal Reserve is not afraid to break the back of the economy to get us there."

On Jan. 31st, the U.S. central bank announced a quarter-point interest rate increase, its eighth consecutive hike since last March, but the smallest adjustment in that streak. The Fed's policy rate is now set to a range of 4.5 to 4.7%, up from roughly zero a year ago. The Fed acknowledged that inflation nationally has appeared to ease, but it is not satisfied with the pace. For that reason, it is said to be considering at least two more times this spring, if deemed necessary.

Many fear that may finally usher Godot on to the stage in the form of a very real recession. But if and when that does come to pass, AEC firms may be better positioned than those in other sectors.

“Construction industry momentum may falter at some point in the future as project financing becomes increasingly expensive,” said Basu. “(But) some contractors will continue to have significant workflow even in the instance of an economywide recession."

Toward that end, he explained, looming megaprojects to improve infrastructure and expand manufacturing capacity across the U.S. should lesson the blow and shorten the duration of any market downturn, whenever it actually gets here.