FROM PRESS RELEASES

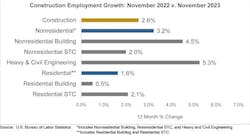

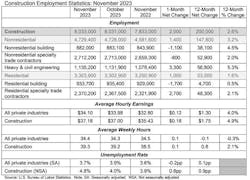

WASHINGTON, December 8, 2023 — Construction employment grew by 2,000 jobs nationwide in November, according to new data from the U.S. Bureau of Labor Statistics (BLS). On a year-over-year basis, industry employment is up by 200,000 since last November, an increase of 2.6%.

That outpaced the overall U.S. economy's job growth of 1.8% during that same 12-month period.

In total, construction employment in November climbed to 8,033,000. Residential building and specialty trade contractors added 1,000 employees in November and 53,000 (1.6%) over 12 months. Employment at nonresidential construction firms—nonresidential building and specialty trade contractors along with heavy and civil engineering construction firms—climbed by 1,400 positions for the month and 147,800 (3.2%) since November 2022.

Overall, the construction unemployment rate rose to 4.8% in November. Unemployment across all industries decreased from 3.9% in October to 3.7% last month.

“U.S. employers once again added jobs at a faster pace than expected in November,” said ABC Chief Economist Anirban Basu. “While construction added only 2,000 jobs for the month, the industry has added jobs at a significantly faster pace than the broader economy over the past year. That’s especially true for the nonresidential sector, in which employment has increased by an impressive 3.2% over the past year. That momentum is largely attributable to megaprojects in the manufacturing sector."

Meanwhile, BLS also reported that wages for hourly employees accelerated nationwide, according to BLS, and the number of unfilled positions reached record highs in October, the Associated General Contractors of America (AGC) reported in analyzing the new government data. AGC Chief Ecomomist Ken Simonson said the new figures indicate the slowdown in hiring is likely because of workforce shortages instead of declining need for labor.

“The steep rise in pay for craft and other hourly workers, along with an earlier report of record job openings heading into November, indicate that contractors are still struggling to find enough skilled workers,” added Simonson. “The slowdown in employment is a sign of how tight the job market is, not an indication that construction demand is lagging.”

Average hourly earnings for production and nonsupervisory employees in construction—covering most onsite craft workers as well as many office workers—climbed by 5.9% over the year to $34.96 per hour. Wage growth accelerated from 5.5% in October. Construction firms in November provided a wage “premium” of more than 19% compared to the average hourly earnings for all private-sector production employees.

Last week, BLS also released a separate on job openings. It showed there were 457,000 openings in construction at the end of October, the highest October total in the 23-year history of the series. Simonson said this was a strong sign that contractors remain eager to hire and that the dip in employment gains in November is more likely a sign of the dearth of qualified workers rather than a slowdown in demand for projects.

“Faster hiring in the industry has coincided with worsening labor shortages, and that has led to rapid increases in labor costs,” added ABC's Basu. “Average hourly earnings for construction employees increased at a faster pace than economywide earnings on both a monthly and yearly basis in November. With nearly half of contractors planning to increase their staffing levels over the six months, according to ABC’s Construction Confidence Index, wage pressures will remain firmly in place through the early parts of 2024.”