PRESS RELEASES

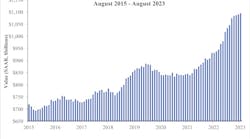

WASHINGTON, Oct. 3 — National nonresidential construction spending increased 0.4% in August, according to the latest data from the U.S. Census Bureau. On a seasonally adjusted annualized basis, nonresidential spending totaled $1.09 trillion for the month.

Meanwhile, the U.S. Bureau of Labor Statistics (BLS) reported that the construction industry had 350,000 job openings on the last day of August, according to its monthly Job Openings and Labor Turnover Survey. JOLTS defines a job opening as any unfilled position for which an employer is actively recruiting. Industry job openings decreased by 3,000 last month but are up by 5,000 from the same time last year.

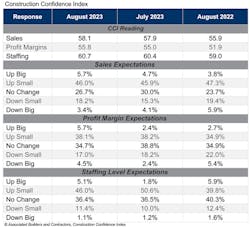

“The number of open, unfilled construction positions declined in August but remains higher than both one year ago and the pre-pandemic level,” said Anirban Basu, Chief Economist for Associated Builders and Contractors (ABC). “Despite the year-over-year increase, the rate at which construction workers are quitting has slowed dramatically as labor constraints ease in other industries that compete for the same workers. With a majority of contractors looking to expand their staffing levels over the next six months, according to ABC’s Construction Confidence Index, any improvements in the labor supply will help contractors keep project costs under control.”

Meanwhile, nonresidential construction spending was up on a monthly basis in 12 of the 16 nonresidential subcategories. Private nonresidential spending increased by 0.3%, while public nonresidential construction spending was up 0.6% in August.

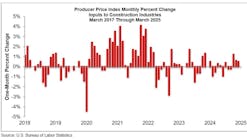

“Aggregate nonresidential construction spending expanded at a respectable rate in August,” said Basu. “But manufacturing-related and public sector projects accounted for more than 100% of the monthly increase. Privately financed commercial- and educational-related construction spending declined by almost 1% at least partially due to elevated borrowing costs.

“Despite high interest rates and ongoing weakness in certain segments like office and retail, contractors remain relatively upbeat,” he added. “Despite still-high materials costs and ongoing labor shortages, a plurality of contractors expects their profit margins to increase over the next six months, according to ABC’s Construction Confidence Index.”

##########