FROM PRESS RELEASES

WASHINGTON DC, NOV. 9, 2021 -- Rising construction materials prices are driving up the price of construction projects, according to concurrent analyses of new U.S. Bureau of Labor Statistics data, conducted by rivals Associated General Contractors of America (AGC) and Associated Builders and Contractors (ABC).

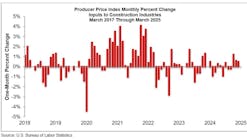

Nonresidential construction input prices increased 1.4% for the month. But overall, construction input prices are 21.1% higher than in October 2020, while nonresidential construction input prices increased 22.3% over that span. Steel mill product prices have increased 141.6% since October 2020, while iron and steel prices are up 101.5%. Softwood lumber prices, which surged during the pandemic, are now down 19.5% from the same time last year.

“After being battered by unprecedented price increases for many materials, contractors are finally passing along more of their costs,” said AGC Chief Economist Ken Simonson. “Meanwhile, supply-chain bottlenecks and labor shortages continue to impede contractors’ ability to finish projects.”

Added ABC Chief Economist Anirban Basu: “Any notion that the bout of pandemic-induced inflation was simply transitory has gone by the wayside. Inflation continues to endure, particularly in multiple commodity categories that directly impact the cost of delivering construction services in America. These materials price increases are simply mind-boggling, with iron and steel prices up more than 100% over the past year."

According to AGC, the producer price index for new nonresidential construction—a measure of what contractors say they would charge to erect five types of nonresidential buildings—jumped 7.1% from September to October and 12.6% over the past 12 months. But an index of input prices—the prices that goods producers and service providers such as distributors and transportation firms charged for inputs for nonresidential construction—climbed by an even steeper 21.1% compared to October 2020, including a 1.3% increase since September, Simonson noted.

- View AGC’s Construction Inflation Alert.

Many products, as well as trucking services, contributed to the extreme runup in construction costs, Simonson observed. The price index for steel mill products more than doubled, soaring nearly 142% since October 2020. The indexes for both aluminum mill shapes and copper and brass mill shapes jumped more than 37% over 12 months, while the index for plastic construction products rose more than 30 percent. The index for gypsum products such as wallboard climbed 25% and insulation costs increased 17%. Trucking costs climbed 16.3%. The index for diesel fuel, which contractors buy directly for their own vehicles and off-road equipment and also indirectly through surcharges on deliveries of materials and equipment, doubled over the year, AGC noted.

Association officials urged the Biden Administration and Congress to do more to address supply chain backups that are crippling construction firms and the broader economy. These measures include additional tariff relief for key construction materials. They also urged federal officials to explore other options, like waiving hours of service rules so shippers can tackle freight backlogs.

“Supply chain backlogs are clearly one of the biggest threats to the economy recovery,” said AGC CEO Stephen E. Sandherr. “Washington officials need to be more aggressive in taking steps to get key materials moving again so construction firms can continue rebuilding the country.”

##########

“Despite increased vaccination levels, global supply chain disruptions persist,” said Basu. “Contractors should expect elevated prices well into 2022. According to ABC’s most recent Construction Confidence Index, the average contractor expects profits to decline over the next six months as the combination of high materials prices and an ongoing shortage of workers conspires to put pressure on margins.”

Released Nov. 9, the latest index readings for sales and profit margins declined in October, while the index for staffing rose slightly. The sales and staffing readings are still above the threshold of 50, indicating expectations of growth over the next six months, explained Basu. The index for profit margins fell below that threshold, pointing to expectations of decline.

Meanwhile, ABC's Construction Backlog Indicator rose to 8.1 months in October, according to an ABC member survey conducted from Oct. 20 to Nov. 2. The reading is up 0.5 months from September 2021 and 0.4 months from October 2020.

“After declining for two months, nonresidential construction backlog bounced back in October,” said Basu. “But some of the renewed momentum appears to be at the expense of profit margins... The good news is that demand for construction services remains elevated."

Overall, current economic conditions and trends suggest that real estate developers are feeling newly encouraged.

“With interest rates low and liquidity high, many investors are seeking positive rates of return through investment in real estate and new construction. Partially as a result, contractors continue to expect sales and employment to grow in the near term. It may be that many project owners have adjusted expectations about construction costs and are ready to move forward despite them. If that stays true, backlog should continue to rise from current levels.”

Note: The reference months for the Construction Backlog Indicator and Construction Confidence Index data series were revised on May 12, 2020, to better reflect the survey period. CBI quantifies the previous month’s work under contract based on the latest financials available, while CCI measures contractors’ outlook for the next six months.

##########