By RICHARD BRANCH, Chief Economist, Dodge Data & Analytics

The past weeks have seen an unprecedented shuttering of the U.S. economy. Our expectations on the impact of the coronavirus on the U.S. economy have been significantly downgraded with a growing realization that the U.S. economy is in recession.

First-quarter GDP is likely to decline close to -0.1% on an annualized basis. Beyond that, it gets much more dire. We are anticipating an annualized decline of 6.3% for GDP in the second quarter as the effect of a shuttered economy fully takes hold. As a point of comparison, the deepest quarterly GDP decline during the Great Recession was an annualized -8.4% in the fourth quarter of 2008.

We presently expect a softer decline in third quarter (-1.1% annualized) under the assumption that containment of the virus is working and some aspects of life return to normal. In the fourth quarter of 2020, we expect a return to growth of 1.5%. For the full year 2020, we expect economic growth to turn negative – declining 0.5%.

The full impact of the pandemic remains largely unknown. This creates larger forecast error and will result in ongoing adjustments to the forecast as we gain additional information.

NOTE: The author will host a one-hour webinar on this developing topic on April 9 at 1 pm ET. Details here.

The impact on construction activity is also uncertain, but it’s clear that it won’t be business as usual. There are several areas of the country where construction has been halted (like in Boston and Cambridge MA) and others where it has been curtailed (such as in San Francisco and Los Angeles where housing construction has been deemed an essential service). Some projects have been delayed, while others appear to be proceeding.

To gain better perspective regarding the immediate impact on construction, we have examined projects that are typically included in our leading indicator of construction activity — the Dodge Momentum Index. These are nonresidential building projects for which Dodge has just issued a first (or initial) planning report. Monthly tracking of these projects has shown them to lead construction spending for nonresidential buildings by a full year. Included in the analysis are nonresidential building projects, excluding manufacturing and transportation, with hard construction costs of less than $500 million.

COMMERCIAL PROJECTS

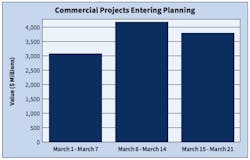

Initial planning projects in the commercial building sector have seemingly held up during the first week of major economic impact (Mar 15-Mar 21). A growing number of people are working remotely, so it seems plausible that remote access has provided private firms with greater flexibility.

Heading into the crisis, the economy was also on solid footing with strong hiring and real estate fundamentals (such as vacancy rates and rents). This should insulate — at least in the short term — the commercial sector’s ability to initiate the planning process by entering projects into the construction pipeline.

In fact, the dollar value of commercial projects entering planning during the first three weeks of March compared to the same period of February shows little to no difference. From a regional perspective, however, commercial planning in the Midwest and West appears to have pulled back, while activity in the South seemed particularly strong last week. (Regional definitions are shown here.)

As the economy continues to rapidly turn south; however, the commercial sector could be more vulnerable to a pullback. The hotel and retail sectors, in particular, appear to be most at risk.

INSTITUTIONAL PROJECTS

Institutional construction; however, has seen a more noticeable reduction in the dollar value of planning projects. Our Dodge data collection staff is reporting that as government offices closed in some areas of the country, it has become more challenging to reach local officials. This could be a short-term issue as government workers adjust to working from home, but we cannot ignore the possibility that the public sector is becoming nervous about committing to future projects in the very uncertain economic environment.

State and local governments are likely to come under increased economic stress this year as unemployed workers strain local safety nets and as tax revenues inevitably fall. To date, the pullback in institutional activity has been broad-based across regions.

While the events of last several weeks are unparalleled, the crisis is still in its very early days. The economic outlook hinges on how quickly containment efforts bear fruit. Fiscal stimulus, combined with the Federal Reserve’s recent moves, will also be key components that determine the trajectory of this recession. The effects will be felt strongly in the construction sector. To help you navigate these uncharted waters, we will continue to provide timely data and analysis.

Based in Hamilton NJ, Dodge Data & Analytics provides analytics and software-based workflow integration solutions for the construction industry. For more information, click here.