Thanks to the media, “retailpocalypse” is now a part of the American lexicon.

The term is generally understood to refer to the widespread closing of brick-and-mortar retail stores, and last year there were more store closings – estimated at 6,700+ – than the 6,163 closings reported in 2008 during the Great Recession. Many well-known brands have shuttered large numbers (or, in some cases, all) of their stores, including such iconic retailers as Kmart, Sears, JCPenney, Ann Taylor, Gap, Banana Republic, Gymboree, Teavana, Michael Kors, Bebe, Perfumania, The Limited, Sports Authority, and Staples. And most recently, Toys-R-Us, which had been operating in bankruptcy since last fall, also threw in the towel and agreed to liquidate all its U.S. stores.

The primary reason, of course, is online shopping. In 2016, e-commerce grew by 15 percent, to nearly $400 billion, and is predicted to reach $632 billion by 2020. One of the latest and fastest growing trends in e-commerce is food. With online grocers offering either in-store pick-up or delivery to your front door, e-retailers like Amazon and supermarket giants like Walmart are changing that industry. Walmart even has a patent on a process that allows shoppers to view real-time photos of the groceries that are available for their online purchase, and they have expanded their online grocery delivery to 100 U.S. cities. Some experts are predicting that online food purchasing, alone, could exceed $100 billion by 2025.

So how, you might ask, does that affect the HVACR industry?

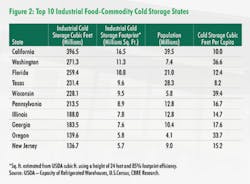

Well, according to a recent report by CBRE, entitled "Cold Storage: About to heat up?", up to 35 million sq. ft. of cold storage could be shifted from retail to industrial properties by 2024, assuming that warehouses mostly replace retail stores for food distribution. And all of this will be taking place while refrigeration equipment itself is undergoing significant scrutiny.

After the EPA issued its proposed rule under the Significant New Alternatives Policy (SNAP) program in 2016, several major retailers announced plans to reduce or eliminate their use of hydrofluorocarbon (HFC) refrigerants in their coolers and freezers. HFCs were developed to replace the ozone-depleting chlorofluorocarbons (CFCs), but are still long-lived greenhouse gases. Target, for example, required all new stand-alone coolers in its stores to be HFC-free and expanded the use of carbon dioxide refrigeration systems to replace HFCs in newly-constructed stores.

Refrigeration compressor efficiency, like that of its air-conditioning cousins, is also an issue. Last year’s U.S. Dept. of Energy (DOE) requirement that energy consumption on new stand-alone commercial refrigeration equipment be reduced by 30 to 50 percent had manufacturers jumping. The good news for our industry is that consumers will still need their food to be fresh and safe. So those refrigeration systems – whether they are being moved or replaced with new installations – will require the involvement of qualified design professionals and trained technicians. Although catastrophic for many retailers, "retailpocalypse" could be a boon for our industry.

A regular contributor to HPAC Engineering and a member of its editorial advisory board, the author is a principal at Sustainable Performance Solutions LLC, a south Florida-based engineering firm focusing on energy and sustainability. He can be reached at [email protected].