PRESS RELEASES

NEW YORK and WASHINGTON, Aug. 5 — Fears of a U.S. economic downturn had persisted for so long that many convinced themselves the mythical "Godot recession" would delay its long-awaited arrival for at least another year, until 2025 or beyond.

But the inevitable reality intervened on Monday, Aug. 5th, when a global stock market selloff that had started in Japan last Friday extended both to Europe and Wall Street today. All three major indexes fell more than 2.5%, with the Nasdaq Composite sliding 3.4% and the S&P shrinking by 3%.

At press time, economic experts were split as to what larger meaning this downturn might hold. Some suggested that the recession had finally arrived, while others called it a long-overdue "market correction" that should really be more welcomed than feared.

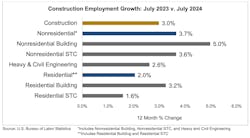

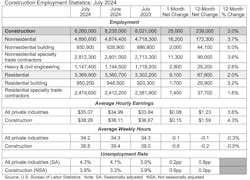

As it is, the construction industry added 25,000 jobs on net in July, according to an Associated Builders and Contractors (ABC) analysis of data released Aug. 2nd by the U.S. Bureau of Labor Statistics (BLS). On a year-over-year basis, industry employment has expanded by 239,000 jobs, an increase of 3.0%.

The construction unemployment rate rose to 3.9% in July. Unemployment across all industries rose from 4.1% in June to 4.3% last month.

“It appears that America is headed into recession,” said ABC Chief Economist Anirban Basu. “While it is true that many economists have been suggesting this for more than two years, the recent slowing in economic activity feels different. Unemployment is climbing rapidly. Consumer spending growth has become more sluggish. U.S. equity markets are generating large losses, an indication that America is caught in a growth scare and that there is a growing consensus that the Federal Reserve has waited too long to begin reducing interest rates."

Noting the incongruity of the moment, Basu tried to explain some of the latest conflicting trends.

“Given that macroeconomic backdrop, it may seem peculiar that the U.S. construction industry managed to add 25,000 jobs in July,” he said. “How can one suggest that the U.S. economy is heading into recession when contractors are still eagerly hiring workers? In this regard, history is instructive. Nonresidential construction industry performance has tended to lag the performance of the overall economy by 12 to 18 months."

According to ABC’s Construction Confidence Index, contractors collectively remain upbeat regarding their prospects for the next six months. But if the economy continues to weaken, and it appears poised to do precisely that, contractor confidence will begin to ebb. Indeed, the June construction spending data released on Aug. 1 indicate that many construction segments are already in slowdown mode, Basu added.

“An exception to this is construction related to manufacturing,” he noted. “The fastest segment of growth in construction spending has been in building construction, which encompasses massive investments in chip-making facilities and other industrial projects. Much of that is fueled in part by federal subsidies. But many construction segments do not benefit from federal subsidies, and those are the sectors that stand to experience the most erosion in performance as the economy softens and elevated borrowing costs linger.”

##########