PRESS RELEASE

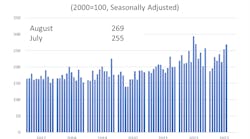

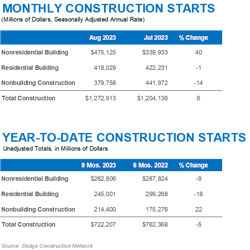

HAMILTON, NJ — September 20, 2023 — Total construction starts rose 6% in August to a seasonally adjusted annual rate of $1.3 trillion, according to Dodge Construction Network. Nonresidential starts rose 40% thanks to a large pickup in manufacturing and transportation buildings. Residential and nonbuilding starts fell 1% and 14%, respectively.

Year-to-date through August 2023, total construction starts were 5% below that of 2022. Residential and nonresidential starts were down 18% and 9%, respectively; however, nonbuilding starts were up 22%. For the 12 months ending August 2023, total construction starts were unchanged. Nonbuilding starts were 20% higher, and nonresidential building starts gained 6%. Conversely, on a 12-month rolling basis, residential starts posted a 17% decline overall.

“Despite the August gain, the construction sector is running uphill,” said Richard Branch, chief economist for Dodge Construction Network. “Fear of an imminent recession seems to have abated, which should provide a boost of confidence to the sector. However, higher interest rates, labor shortages and significantly tighter lending standards will weigh down starts in the final quarter of the year. This will persist for the foreseeable future, lasting until interest rates start to move lower.”

Nonbuilding

Nonbuilding construction starts lost ground in August, falling 14% to a seasonally adjusted annual rate of $380 billion. The decline follows a strong July which saw the start of a $12-billion LNG project. Nonbuilding starts increased 12% in August when excluding the utility/gas plant category, which fell 45% during the month.

Miscellaneous nonbuilding starts shot 39% higher, and highway and bridge starts gained 19%. However, environmental public works starts shed 1%.

Year-to-date through August, nonbuilding starts gained 22%. Utility/gas plants rose 40%, and miscellaneous nonbuilding starts were up 33%. Highway and bridge starts gained 13%, and environmental public works rose 17%. For the 12 months ending August 2023, total nonbuilding starts were 20% higher than that of August 2022. Utility/gas plant and miscellaneous nonbuilding starts rose 23% and 30%, respectively. Highway and bridge starts were up 17%, and environmental public works rose 18% on a 12-month rolling sum basis.

The largest nonbuilding projects to break ground in August were the $3.5 billion TransWest Transmission Project spanning Wyoming, Colorado, Utah and Nevada, the $2.9-billion Mid-Barataria Sediment Diversion projects in Port Sulphur, LA, and the $1.5-billion New England Clean Energy Connect Power Line in Maine.

Nonresidential

Nonresidential building starts gained 40% in August to a seasonally adjusted annual rate of $475 billion, largely due to a surge in manufacturing activity. Nonresidential building starts would have gained 24% when excluding these large manufacturing projects.

Commercial starts rose 8% in August led by gains in parking structures and hotels, and institutional starts rose 35% with all sectors but dormitories increasing. Manufacturing starts rose 285% from July to August, fueled by two large projects.

On a year-to-date basis through August, total nonresidential starts were 9% lower than that of 2022. Institutional starts gained 3%, while commercial and manufacturing starts fell 8% and 32%, respectively. For the 12 months ending August 2023, total nonresidential building starts were 6% higher than that ending August 2022.

Manufacturing starts were 2% higher. Institutional starts improved 8%, and commercial starts gained 6%. The largest nonresidential building projects to break ground in August were the $2.5-billion John Palmour Manufacturing Center for Silicon Carbide in Siler City, NC, the $2-billion VinFast electrical vehicle plant in New Hill, NC, and the $1.4-billion Midfield Satellite Concourse at Los Angeles International Airport in California.

Residential

Residential building starts fell 1% in August to a seasonally adjusted annual rate of $418 billion. Single family starts gained 2%, while multifamily starts lost 5%. On a year-to-date basis through August 2023, total residential starts were down 18%. Single family starts were 21% lower, and multifamily starts were down 12%. For the 12 months ending in August 2023, residential starts were 17% lower than in 2022. Single family starts were 23% lower, while multifamily starts were down 3% on a rolling 12-month basis.

The largest multifamily structures to break ground in August were the $530-million Hub on Campus mixed-use building in Knoxville, Tennessee, the $425-million 250 Water Street mixed-use tower in New York, New York, and the $340 million Ritz Carlton residences in North Palm Beach, Florida.

Regionally, total construction starts in August rose in the Midwest, South Atlantic and West regions, but fell in the South Central.

- Watch Dodge Chief Economist Richard Branch discuss August Construction Starts here.

##########