Trends, Issues, and Best Practices in HVACR and Buildings 2017

OppoRTUnities Abound

By MICHAEL DERU, PhD, Engineering Manager, Commercial Buildings Research Group, National Renewable Energy Laboratory

According to the U.S. Energy Information Administration, HVAC accounts for approximately 38 percent of U.S. commercial buildings’ primary energy consumption and a slightly higher percentage of their greenhouse-gas emissions. We have seen incredible gains in efficiency made with lighting, going from incandescent and T12 fluorescent bulbs to high-efficiency LEDs, but there are even greater advances to be made with HVAC. Gains of 20 percent to 30 percent easily can be made by replacing older degraded equipment with new high-efficiency equipment. Even more savings are possible with an integrated engineering approach yielding optimized system designs combined with highly efficient controls.

This all means there is tremendous opportunity for HVAC engineers to apply intelligent design and operation to achieve cost savings and improved thermal performance. Luckily, there have been great improvements in the performance of HVAC systems and in sensors and controls in recent years, providing a solid starting point. However, the biggest savings are in proper design and operation of HVAC systems.

In a one-for-one replacement, a new high-efficiency rooftop air-conditioning unit (RTU) can use less than half of the energy of an old degraded RTU. However, it may be difficult to make an economic case for the highest-efficiency units. One retailer developed an “optimized re-engineered” approach taking advantage of reduced lighting loads, a redesigned ventilation system, improved controls, and tighter design criteria to reduce installed cooling tons (and costs) by an average of 30 percent and achieve a 40-percent reduction in HVAC energy and operation costs over an already efficient system. Thirty-percent energy savings have been seen in chilled-water-system replacement scenarios, according to the U.S. Department of Energy’s Better Buildings Solution Center.

You don’t have to replace HVAC systems to see significant savings. Most HVAC systems do not operate anywhere close to their optimal efficiency. Retrocommissioning or retrofitting existing systems can provide significant savings. Many building owners have achieved significant savings with existing RTUs by installing advanced RTU control retrofit packages that can provide 20-percent to 50-percent savings with one- to four-year payback periods.

If you are an engineer or energy manager looking for significant energy savings, take an integrated, holistic approach to your building and building systems. First, reduce loads. Then, take a close look at the HVAC-system requirements to optimize the design and controls. Properly size HVAC systems, turn things off when they don’t need to run, and use variable-speed fan and pump drives for improved part-load performance. Unfortunately, there is not a one-size-fits-all solution for buildings. The challenge with HVAC systems is that they are more complicated than other building systems, and more time and energy has to be put into a solution; however, incredible performance gains can be achieved with proper application of an intelligent approach to design and operation.

The fun part about being a HVAC engineer is that there always is something new to learn about. Future HVAC systems will be even more efficient, with very low greenhouse-gas contribution, as we shift to new refrigerants and non-vapor-compression cooling and heating. Always keep learning and applying sound engineering practices to get the best results.

Get Smart(er)

By GREG TURNER, Vice President, Honeywell Building Solutions

Traditionally, predicting how an organization’s operating costs will change week to week or even month to month has been difficult because of a variety of fluctuating factors. While recent periods of low wage growth and stable energy costs have helped to ease the management burden, these trends aren’t likely to last forever. Thus, as we start 2017, it’s a good time for facility managers and organizational leaders to take stock of ways to better manage variability using the wealth of data available from building systems.

While the notion of smart buildings isn’t new, the possibilities of what they can achieve is ever-expanding. The concept of the Internet of Things (IoT)—which centers on the fundamental notion of connectivity between everything, from infrastructure to devices—is helping to fuel the advancement of smart buildings, allowing facility managers to access actionable information to optimize how a facility is operated and better forecast and manage issues such as cost fluctuations.

IoT-enabled connectivity is the base platform to make this possible, but deep insight gained from analytics related to repairs, operations, space usage, occupancy levels, and energy costs is key. Such insight can drive automated actions to solve real business problems. None of us has time to look through mountains of data every day or week. Now, because of this connectivity, we can expect building systems to detect and report variations and, in many cases, even take actions to resolve potential issues, whether it is changing an operating sequence because of a mechanical issue, shedding load to meet a demand target, or creating a work order for a contractor.

Better Focus With Predictive Maintenance

New cloud-based technologies such as predictive maintenance are emerging, thanks to the connectivity enabled by smart buildings. These solutions help organizations focus maintenance activities where they can best impact overall building performance. Combining the connectivity of a smart building with automation and data analytics turns buildings into more productive organizational assets while helping to save time and money.

For example, a facility manager follows a traditional maintenance schedule for all of a building’s chillers for two to three months. With predictive analytics, the system forecasts the number of run hours before a chiller’s performance degrades and the chiller requires maintenance. That forecast is constantly evaluated so that maintenance work is scheduled at the optimum time to maximize asset life, reliability, and energy efficiency while keeping labor costs down.

Optimizing Performance With Data Analytics

Most buildings already generate incredible amounts of data that can lead to critical insights that benefit an organization. That data, however, frequently is not organized in a way that allows for easy analysis. Cloud services are emerging as a way to help manage and organize data, and a data framework can lend itself to intelligent analytics that improve decision making. For example, a large campus recently tapped into the actual performance of 220 chillers across a broad range of conditions, rather than rely on traditional age-based models to create a capital-replacement master plan.

Connectivity enables a building’s performance data and analytics to be delivered directly to a facility manager’s mobile device. As a result, facility managers can receive timely notifications of possible issues, along with real-time data to assess issue impact, allowing them to take immediate action, no matter where they are located.

An organization’s ability to forecast needs, quantify business impacts, prioritize actions, and respond swiftly will be critical when energy costs rise and wages grow again. Smart buildings enable an organization to capture and act on valuable insights that can identify problems before they start impacting the bottom line and reveal opportunities to optimize overall operations. We can’t always know when changing factors will impact operating costs, but making investments for smarter buildings now will ensure we are ready whenever they do.

Seizing the Moment

By SCOTT E. DERBY, Vice President and Partner, SmartEdge, and 2016-2017 President, InsideIQ Building Automation Alliance

With a new presidential administration comes new opportunities.

President-Elect Donald Trump campaigned on the promise he will “make America great again” through a pro-business, pro-growth mentality. Whether or not you voted for him, you have to admit the country is energized. Talk of major infrastructure improvements, lower corporate taxes, and retaining U.S. employers is a welcome sign for the new-construction and renovation building trades.

Upgrades of the nation’s outdated energy infrastructure will be key to any major economic-growth plan. Simply making more coal available to our existing coal-fired power plants won’t solve the problem by itself, as many coal plants will need years of regulatory changes to occur and millions of dollars in investment. Smarter energy generation, improved distribution, and efficient usage will be required to power our economic growth. Microgrids and alternative energies will have an important role in stabilizing our utility infrastructure. Timing is critical, and even the most aggressive supply- and distribution-improvement plans will take billions of dollars to fund and years to implement, which is why I believe the smart-buildings industry has a golden opportunity to step up and seize the moment.

From smart cities to smart buildings, the Internet of Things is enabling technology to reduce the nation’s demand-side consumption and optimize building performance. As buildings and equipment become more connected, we develop an abundance of data that, when utilized properly, can produce important benefits, such as reduced energy consumption, lower operating costs, and higher people productivity. These improvements, when coupled with supply and distribution investments, will shrink the cost and turnaround time needed to support the growth we’re all hoping for.

From Slide Rules to Integrated Design: Adapting to Change

By TIM WENTZ, PE, FASHRAE, HBDP, Faculty Member, Durham School of Architectural Engineering and Construction, University of Nebraska–Lincoln, and 2016-2017 President, ASHRAE

ASHRAE’s theme for 2016-2017, “Adapt Today to Shape Tomorrow,” has as its symbol a simple slide rule. It seems odd, doesn’t it? One of the world’s premier HVACR engineering organizations using as iconography a tool that hasn’t been in wide use since the advent of the hand calculator in 1972.

Of course, that is the whole point. For many of us, the early ‘70s doesn’t seem that long ago (trust me on this, it wasn’t). How far we’ve come in such a short span of time is a sobering thought. Even more sobering is the thought of where we will be in 20 years, or even 10 years. The mind boggles if one isn’t careful.

Instead of being intimidated by the rate of change, ASHRAE is committed to adapting to change because we know that unlocking the power of adaptation is the key to transforming lives, organizations, and communities. So, what changes will our industry need to adapt to? We foresee three driving forces of change impacting our industry in the near future.

The first wave of change is yet another technology revolution. These revolutions occur so frequently they are an expected part of every industry. A good example is the evolution of driverless cars. Ten years ago, if I had said a blind person should be able to drive a car anytime anywhere without a license, I would have been laughed out of the room. Today, it is an obvious conclusion. I think our discipline is at the same tipping point as driverless cars. Growth in hardware and software capability and sophistication will allow programs such as building information modeling to give a whole new meaning to the term “design assist.” ASHRAE is preparing its members for this change by increasing educational offerings in areas related to modeling and design, creating a technology portal linking members to cutting-edge research, expanding its library of apps so changes in technology can be made faster, and more.

New technology will set the stage for a second wave of change by creating an environment more conducive to integrated design. ASHRAE is preparing its members for this change by working with groups such as the Mechanical Contractors Association of America and APPA: Leadership in Educational Facilities to create the networks necessary for the development of truly integrated design and construction processes and standards. Additionally, ASHRAE is writing integrated-design compliance paths into many of its products.

The combination of new technology and integrated design will allow us to focus on building performance as our design and construction standard. Historically, our industry has used a very prescriptive process to design and construct buildings. Imagine a future in which, working in concert, we can optimally design and construct buildings meeting our clients’ expectations, producing comfortable, healthy, and productive spaces while minimizing impacts on our environment. Here again, ASHRAE is hard at work preparing its members for change. Many of ASHRAE’s new standards, for example, contain alternate compliance paths based on building performance, and ASHRAE has greatly expanded its research efforts in many related areas, including refrigerants with low ozone-depletion potential, low global-warming potential, and better energy efficiency. ASHRAE’s new energy-management tool, Building EQ, meanwhile, accurately measures energy performance, a necessary step in controlling energy use.

The exciting part of this conversation is our role in the process. We can create our future with respect to human comfort, indoor-air quality, and energy efficiency. More to the point, we must create this future; it is the legacy we will give our children and grandchildren.

Putting Occupants First

By ROBERT HEMMERDINGER, Director, Business Development, SmartStruxure, Schneider Electric

"The war for talent,” it has been said, “is over, and the talent won.”1 Young, high-performing employees are making known their desire for work environments meeting their needs for mobility, flexibility, and lifestyle balance. For companies looking to attract and retain this talent, the pressure to provide smart, connected spaces in which employees relish spending time is on.

At the same time, these companies are facing the challenge of increasing real-estate costs, especially in cities, which is where many Millennials want to live. Thus, property managers are looking for ways to decrease their footprint by utilizing mobile working, hot desking, flexible room allocation, and remote work policies.

This provides a unique opportunity for technology providers. Traditionally, their focus has been on the facility manager or energy manager and trying to make his or her work day easier, more productive, and more efficient. That still is important; however, putting the occupant at the center of a smart connected building—creating solutions that help him or her park efficiently; book a room, desk, or meeting room; locate colleagues or customers; and control the comfort of spaces (HVAC, lighting, blinds, etc.)—will prove to be more advantageous. Employees who work in a smart, connected, vibrant environment work longer and more efficiently and are much more likely to recommend their employer to others. Such a building becomes part of the brand, part of the persona, of an organization. It becomes a testament—to not only employees, but visitors, vendors, and investors—to the company’s vision and priorities.

A focus on the occupant and the development of building technologies according to his or her needs does not preclude the realization of benefits by the facility-management team. The team can better understand where people are or, more importantly, where they are not. The facilities team could decide not to heat or cool a space, a floor, or, in a campus scenario, an entire building, consequently reducing energy costs based on real-time building usage. The team could choose not to clean an area that hasn’t been used or provide occupant information to the cafeteria, allowing workers there to properly and efficiently plan for the day.

Buildings are getting smarter, providing more value to the owner, using less energy, becoming easier to manage, and, most importantly, creating a much more exciting user experience for the occupant.

- Bersin, J. (2013, December 19). The year of the employee: Predictions for talent, leadership, and hr technology in 2014. Forbes. Retrieved from http://bit.ly/Bersin_121913

The New Refrigerants

By BRIAN S. SMITH, Director of Global Marketing, Chiller Solutions, Building Technologies & Solutions, Johnson Controls

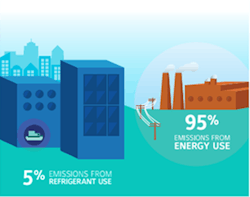

On Oct. 15, 2016, 197 countries gathered in Kigali, Rwanda, and signed the Kigali Amendment to the Montreal Protocol on Substances That Deplete the Ozone Layer. The signing countries agreed to address greenhouse-gas (GHG) emissions through a phasedown of hydrofluorocarbon (HFC) refrigerants in all industry sectors. The goal of this landmark agreement is to achieve an 80- to 85-percent global reduction in carbon-dioxide equivalence by 2047. For manufacturers, this means providing products that use low-global-warming-potential (GWP) refrigerant technologies while improving equipment operating efficiencies.

The action taken in Kigali affects all industries that use HFCs. For developed countries such as the United States, the first step-down date is 2019, and the goal is 10-percent reduction of the baseline. In the United States and Europe, this goal will be met or exceeded based on already identified and finalized regulations, such as the U.S. Environmental Protection Agency’s Significant New Alternatives Policy (SNAP) Final Rule and the European Union’s F-gas (fluorinated gas) Regulation, which has identified phasedown plans for HFC refrigerants in new equipment for the foam, automotive, and commercial refrigeration industries.

The HVACR industry supports the Kigali Amendment. It is a global agreement with built-in accountability and enforcement mechanisms.

This transition, however, is not without challenges.

Flammability

First, many of the proposed alternatives to existing refrigerants, including all of the alternatives to R-410A, are mildly flammable. The use of these refrigerants in applications in which they have not been proven to be safe raises questions related to equipment standards, building and fire codes, construction practices, manufacturing processes, material handling, and life-safety procedures.

Impacts on Efficiency and Sustainability

Some of the lower-GWP alternative refrigerants reduce equipment efficiency. This means additional energy is required to produce a specified level of cooling, which can lead to higher emissions. What’s more, decreased efficiency can cause building owners and mechanical engineers to specify larger or additional equipment to meet cooling requirements, leading to increased first costs and, again, higher emissions. In some cases, reduced efficiency cancels the benefits of using a lower-GWP refrigerant.

Availability and Costs

Many of the proposed alternative refrigerants are not yet available in large quantities (most refrigerant producers are forecasting the bulk of their production to come online in 2018 and beyond). The limited availability of these new refrigerants can mean significant premiums. As long as the supply remains limited, the first cost may be prohibitive. Additionally, the risk is greater, as is the potential for downtime. And in cases in which flammability is an issue, there may be costs associated with facility safety equipment, increased ventilation requirements, and higher insurance premiums.

Conclusion

It is important to note equipment owners are not yet required to switch to a new refrigerant. At this time, HFCs, unlike hydrochlorofluorocarbons R-22 and R-123, are not scheduled for phaseout, which makes them a safe, economical option while alternatives are studied.

All of this is to say the selection of low-GWP refrigerants should be made with careful consideration of flammability, equipment efficiency, sustainability goals, and availability. Only by understanding the full impact of each on safety, emissions, and cost can decisions that are truly beneficial to building owners and the environment be made.

Green-Building Megatrends

By JERRY YUDELSON, PE, MS, MBA, LEED FELLOW—“Godfather of Green” (WIRED Magazine), Sustainability Consultant, Keynote Speaker, and Author of 14 Books on Green Building and Related Topics

In my latest book, “Reinventing Green Building: Why Certification Systems Aren’t Working and What We Can Do About It,” I identify 10 megatrends I believe will shape green-building technologies, markets, government rules, and certification systems through 2020 and beyond. The thing about a megatrend is it can’t be wished away; it’s here to stay. The question is how will we take advantage of it.

Incidentally, I don’t think the election of Donald Trump will in any way disturb these trends.

Green-Building-Certification Growth Has Stopped

Since 2012, the United States has experienced a slowdown in green-building certification. As a result, projects outside the United States now make up nearly 35 percent of annual total LEED (Leadership in Energy and Environmental Design) certifications. New and more costly requirements for using LEED v4 indicate nothing is going to change this picture.

At the end of 2015, total U.S. LEED-certified space remained abysmally low: about 3.4 billion sq ft, or about 4 percent of the 86-billion-sq-ft total area of existing commercial buildings. This doesn’t mean important elements of sustainable design are being ignored; it just means certification as a practice is falling by the wayside.

Carbon Reduction From Energy Efficiency Is Moving to the Fore

Opportunities in energy efficiency remain significant, with most concentrated in just 25 percent of the building stock, according to FirstFuel Software Inc. A cost-effective approach to upgrading existing buildings should first attempt to take advantage of this concentration. For example, over the past few years, the U.S. General Services Administration (GSA) audited 180 buildings remotely using FirstFuel software and identified more than $13 million in annual savings.

Zero-Net-Energy Buildings Are Drawing Greater Interest

To be newsworthy, a project needs to incorporate something new. Increasingly, that something new is zero net energy (ZNE). Developers of speculative commercial buildings have begun to showcase ZNE designs to differentiate their projects. This trend has been developing slowly since about 2011 and now seems ready for more rapid growth. Of course, the key to net zero is first to get building energy demand as low as possible—below an estimated energy-use intensity of 30 on most new-building projects.

Competition Among Rating Systems Is Intensifying

In the United States, LEED may see heightened competition in new-construction rating from Green Globes and possibly new entrants in specialized niches, such as retail and office interiors. In 2016, the federal government once again put LEED and Green Globes on equal footing for government projects, while the BREEAM In-Use rating system emerged as a competitor to LEED for existing buildings. The biggest competitor for certification systems, however, is the DIY (do-it-yourself) approach favored by many owners or the “LEED-certifiable” approach, whereby LEED is used for design and operations guidance, but certification is not pursued.

Building Owners Are Sharpening Their Focus on Efficiency Gains

With new-construction certification basically flat, the existing-building market is getting more attention, particularly with energy-efficiency retrofits and a renewed focus on the ENERGY STAR system. However, LEED for Existing Buildings: Operation & Maintenance (EBOM) accounted for fewer than 600 building certifications—about 0.01 percent of the total U.S. nonresidential-building stock of 5.6 million buildings—in 2015. This means that as more owners of existing buildings implement energy-efficiency retrofits, they are quite likely to pass on LEED EBOM certification.

Cloud Computing and Big-Data Analytics Are Growing in Power and Application

Increasingly, building owners and third-party service companies are managing large buildings remotely, using software platforms providing performance monitoring, data analytics, visualization, fault detection and diagnostics, portfolio energy management, and text messaging, all using the cloud.

Cities and States Are Demanding Building-Performance Disclosure

Major U.S. cities are on board with climate-change policies stemming from the U.N. climate agreement that went into effect in 2016. That the Trump administration may withdraw the United States as a signatory will not affect actions many cities and states plan to take. Among those actions is requiring commercial-building owners to disclose building performance to tenants, buyers, and, in some cases, the public. Expect this to become increasingly common, putting pressure on owners to invest in energy-efficiency retrofits and renovations.

Interest in Healthy Buildings and Green-Building Products Is Increasing

There is little doubt interest in healthy buildings and green-building products will continue to rise. The move of U.S. Green Building Council founding chair Rick Fedrizzi to the International WELL Building Institute puts a top green-building salesman in front of this movement. Software from companies such as ecomedes and Sustainable Minds makes it easy to sort through and select from thousands of building products.

Solar Power Has Gone Mainstream

A number of states are expected to implement aggressive renewable-portfolio standards. Solar accounts for an increasing percentage of new electric-capacity additions each year, reaching 26 percent in the first half of 2016. Solar has the potential to radically alter how buildings are designed, built, and operated over the next five to 10 years.

Water Conservation Continues to Gather Steam

Awareness of the coming crisis in fresh-water supply in many parts of the world will increase, as global climate change continues to affect rainfall and water-supply systems worldwide. The 2014-2016 drought in California, which saw more than 70 percent of the state experience extreme drought conditions and led to a 25-percent reduction in water use, brought national attention to water concerns.

These 10 megatrends will accelerate the proliferation of low-carbon green buildings, the adoption of renewable energy in buildings, and the promotion of water-conserving architectural design over the next 10 years.

Accelerated PACE

By LAWRENCE “LARRY” CLARK, QCxP, GGP, LEED AP+, Energy and Sustainability Consultant, Sustainable Performance Solutions LLC

Property Assessed Clean Energy (PACE) financing continued to expand in 2016, and I believe its growth in 2017 will be even more impressive.

Called a “world-changing idea” and one of “20 ways to build a cleaner, healthier, smarter world” by Scientific American magazine, PACE is a means of financing energy-efficiency upgrades, water-conservation improvements, and renewable-energy installations for commercial and residential buildings. It is available in 32 states and the District of Columbia. Sixteen states have active commercial PACE programs that can be used to finance HVAC upgrades.

Although PACE has been around since 2008, its early adoption was hampered by court challenges and by the refusal of government mortgage guarantors, such as the Federal Housing Finance Agency (through Fannie Mae and Freddie Mac), the Federal Housing Administration (FHA), and the U.S. Department of Veterans Affairs (VA), to accept PACE residential loans. In 2015, the FHA and VA changed their positions, and the cumulative residential dollars securitized by PACE increased by more than 300 percent in the ensuing 12 months.

PACE is unique in that it is tied to properties, not to owners (hence, no requirement for personal guarantees), and repaid through a special non-ad valorem tax assessment. It is true off-book financing, and if a property is sold, the PACE assessment goes with it.

Commercial PACE has grown some 300 percent over the last couple of years and is poised to pass the thousand-project mark. I believe 2017 should see commercial PACE approach a billion dollars in cumulative project financing. It is hoped HVAC retrofits will be a significant part of that.

Resilient Buildings

By JIQIU (JQ) YUAN, PhD, PE, Project Manager, and RYAN M. COLKER, JD, Presidential Advisor, National Institute of Building Sciences

Natural disasters—hurricanes, tornadoes, floods, earthquakes, wildfires—are inevitable. Rather than sit idly by, many communities, business owners, and policy-makers are being proactive, embracing the adage that, “An ounce of prevention is worth a pound of cure.” Through planning, smart investment, and a holistic approach, they are taking steps to soften the blow from natural disasters and recover more quickly.

In 2014, more than three dozen organizations responsible for the design, construction, and operation of buildings, homes, transportation systems, landscapes, and public spaces, including ASHRAE, the U.S. Green Building Council, the National Fire Protection Association, Building Owners and Managers Association International, and the International Facility Management Association, came together to address the issue of resilience. In their Industry Statement on Resilience, they define resilience as “the ability to prepare and plan for, absorb, recover from, and more successfully adapt to adverse events.”

In 2005, the National Institute of Building Sciences’ Multihazard Mitigation Council (MMC) published “Natural Hazard Mitigation Saves: An Independent Study to Assess the Future Savings From Mitigation Activities,” a Federal Emergency Management Agency- (FEMA-) commissioned report demonstrating that for every public dollar spent on mitigation, society saves $4. Subsequent studies have confirmed that finding. A 2016 study by the Risk Management and Decision Processes Center at the Wharton School of the University of Pennsylvania, “Economic Effectiveness of Implementing a Statewide Building Code: The Case of Florida,” found investing in mitigation exceeds the MMC’s 4:1 benefit-cost ratio. The study found that from 2001 to 2010, windstorm losses in Florida, which adopted and implemented one of the strictest building codes in the nation in 2002, fell by up to 72 percent. The authors concluded that every dollar spent on mitigation avoided $4.80 in losses, with a payback period for the investment in stronger codes estimated at approximately 10 years in a state at high risk for severe windstorms.

While the benefits of investing in resilience are proven, there has been a significant gap between communities’ resilience preparedness and the frequency and intensity of disasters. The number of presidential declarations of disasters has been climbing, as has the number of disasters causing over $1 billion in damages. Meanwhile, from 2005 to 2014, Congressional appropriations for FEMA pre-disaster-mitigation (PDM) grants averaged just $120 million a year, compared with the $7.2 billion spent on recovery assistance. In 2015, FEMA requested $400 million for PDM, but received only $81 million.1

In the end, no matter how a community prioritizes resilience, unless consumers, including property owners, building operators, and residents, believe they will incur an advantage for their investment, little will happen. While technical research has identified effective mitigation measures, a connection between engineering solutions and economic motivation is needed. A ground-breaking report and addendum recently released by the MMC and the National Institute of Building Sciences’ Council on Finance, Insurance and Real Estate identifies the basis for a cost-effective resilience strategy through a holistic and integrated set of public, private, and hybrid programs capturing opportunities available through mortgages and loans, insurance, finance, tax incentives and credits, grants, regulations, and enhanced building codes. Meanwhile, the MMC, with support from federal agencies and private-sector organizations, including the International Code Council and the Insurance Institute for Business & Home Safety, is conducting an update to and expansion of its 2005 study on the value of investing in mitigation.

Despite a decades-long focus on hazard mitigation and reducing disaster losses, the federal and state governments continue to be burdened with the lion’s share of responsibility for absorbing local losses and restoring communities following a disaster. It is time for all stakeholders to work collaboratively toward the implementation of mitigation strategies and to get involved in encouraging local investment in resilience to help build a national resilience economy.

Achieving resilience at the community scale also requires collaboration across all disciplines engaged in the design, construction, and operation of buildings and infrastructure. Architecture, engineering, and construction (AEC) professionals, including HVAC experts, provide an important perspective on how resilience strategies can be implemented and what measures can be employed practically. Working with building owners and regulators, HVAC professionals can help to identify the most cost-effective strategies to meet community and owner expectations.

With natural-hazard events expected to grow in frequency and impact, the building industry increasingly will be looked to for solutions. AEC professionals must educate themselves on current strategies for resilience (e.g., elevating critical equipment and systems to reduce the risk of flood hazards and securing piping and HVAC equipment for high winds and earthquakes) and the benefits of their implementation and then share that knowledge with their clients. By understanding the long-term value of investing in resilience strategies—and being able to convey that to clients—HVAC professionals can help to support expanded retrofit opportunities and show their interest in safeguarding the long-term viability of their projects, clients, and communities.

- Miller, T.R. (2016, August 4). Build disaster-proof homes before storms strike, not afterward. The Conversation. Retrieved from http://bit.ly/Disaster_Proof

State of the HVACR and Water-Heating Industry

By STEPHEN YUREK, President and Chief Executive Officer, Air-Conditioning, Heating, and Refrigeration Institute

We begin 2017 in a very good place as an industry. Year-over-year shipments were up in many categories, including commercial gas and electric water heaters, in 2016. This is an indication our industry is strong and vibrant, which we expect to continue this year.

The 2016 elections have brought about significant changes. Our industry will be collaborating with an administration, a House of Representatives, and a Senate that are pro-business to some degree. Therefore, it is reasonable to expect a willingness to hear and address our concerns with respect to energy and environmental issues. Importantly, the regulatory structure under which we have operated appears to be in for a dramatic change with the ushering in of a new administration.

Over the last several years, both our staff and our member companies have spent considerable time on Capitol Hill talking to representatives and senators about changes in the regulatory structure we would like to see. Additionally, we have engaged in discussions about the manner in which our products and equipment are treated in the tax code.

In 2016, our current vice chairman, Chris Peel of Rheem Manufacturing Co., and I testified before the House Subcommittee on Energy and Power to present commonsense changes to the Energy Policy and Conservation Act (EPCA), the law governing regulation of many of the products our members manufacture.

Our industry supported the EPCA when it was passed during the 1970s because one national efficiency standard for each covered product, combined with strong federal preemption, made more sense than a mishmash of state and local efficiency standards that would have challenged our ability to provide the products and equipment our customers desired. The law worked fairly well for a number of years, but with industry advances and several amendments by Congress, it has devolved into an endless cycle of ever-more-stringent efficiency requirements for an ever-increasing number of HVACR and water-heating products. The law has become so rigid, in fact, it prohibits the U.S. Department of Energy from making changes to a published standard even if the changes are needed to correct errors in the rule.

In the new political environment, we will seek positive, commonsense changes to eliminate unnecessary serial rule-making, raise the bar of economic justification, and promote negotiated solutions. Our goal is to advocate for smart, science-based rules instead of rigid, out-of-date regulations that stifle growth and opportunity.

Tax policy is another area in which we are looking to enact reforms that encourage growth and more accurately reflect the realities of our industry. For example, the depreciation schedule for commercial equipment is set at 39 years, which, at nearly twice the average lifespan, discourages building owners from replacing older, less efficient equipment in a time frame making environmental or economic sense.

In addition to these policy objectives, we will continue our Industry Awareness Campaign, which demonstrates to policy-makers at all levels our commitment to a regulatory structure that brings stability and consistency to our marketplace while providing the quality, energy-efficient products and equipment our customers want and expect.

We will work with the new administration to promote the benefits our industry provides to its customers and the 1.2 million individuals it employs in the United States. At the same time, we will continue to work with all stakeholders, including environmental advocacy groups, to affect positive change.

Being successful in all of our objectives means working together as one industry, with one voice. We need to continue working closely with like-minded partners, such as ACCA, HARDI, PHCC, ASHRAE, and appliance and electrical manufacturers. We need to continue to engage with them as part of a broader coalition of stakeholders to bring about commonsense reforms. My hope is we all can commit to moving forward as a united industry because the successes we hope to achieve will make a real difference in American manufacturing and the lives of every American.

Variable-Speed Everything

By JOHN GALYEN, President, Danfoss North America

Nationally, talk of doubling U.S. energy productivity by 2030 is growing louder. Representing nearly 36 percent of U.S. electricity consumption and 21 percent of primary energy consumption, existing buildings are an ideal target in the pursuit of greater energy productivity.

Fortunately, the energy performance of buildings is expected to improve significantly in the decades ahead: From 1980 to 2009, for every 1 percent of growth in U.S. commercial-building space, primary energy consumption increased 1.19 percent; from 2009 to 2035, the U.S. Energy Information Administration estimates, for every 1 percent of growth in U.S. commercial-building space, primary energy consumption will increase only 0.79 percent.

How will those predicted energy savings be obtained? Through the many proven technologies available today, such as variable-speed … everything.

With HVAC equipment accounting for 40 percent of commercial-building energy consumption, substantial reductions in use can be achieved with mechanical equipment capable of modulating capacity and lowering speed, such as variable-speed compressors, fans, and pumps. Variable-speed equipment provides the additional benefit of enabling systems to better match capacity to demand to operate efficiently at part-load conditions.

For example, on one project, two 150-ton chillers were replaced with one 150-ton variable-speed chiller, which improved efficiency 42 percent.

Variable-speed technology not only improves efficiency, performance, and comfort, it helps to address peak-demand concerns, allowing utilities to control the speed of a unit intelligently and minimize impacts on occupants.

At the 64-story U.S. Steel Tower in Pittsburgh, installation of more than 150 variable-speed drives for domestic-water supply and fan and pump motors over a nearly 15-year period produced annual energy savings totaling more than $1.1 million (see “VFD Retrofits Lower Skyscraper’s Energy Consumption,” December 2016). The variable-speed technology aided participation in demand-response programs, while the 34-percent reduction in energy consumption enabled the property-management company to obtain rebates from the local utility.

Imagine the possibilities if variable-speed technology were deployed on a greater scale.

Moving to “variable-speed everything” is a step on the path to doubling our energy productivity and making our buildings more sustainable. To encourage the broader deployment of variable-speed technology, we need supportive regulations and standards and the right package of incentives.

We’re on our way, but the journey is far from over.

Becoming a More Effective Project Manager

By KENNETH M. ELOVITZ, PE, Esq., Engineer and In-house Counsel, Energy Economics Inc., and Adjunct Teaching Professor, Architectural Engineering, Worcester Polytechnic Institute

In 2009, Atul Gawande, a surgeon at Boston’s Brigham and Women’s Hospital, wrote a book called “The Checklist Manifesto: How to Get Things Right.” Gawande’s premise is that no matter how well-trained people might be, checklists aid recall and help avoid errors, especially in high-pressure or hectic situations.

HVAC engineers who serve as their firm’s project manager or project coordinator rarely face life-and-death or emergency situations. Yet a checklist with ideas like the ones presented here might help to avoid errors or oversights, improving project outcomes.

Consult the architect and structural engineer to confirm the roof structure is stiff enough for rooftop-equipment vibration and noise isolation.

Consider a 20-ton rooftop air-conditioning unit with a 7.5-hp supply fan turning at 970 rpm. For a fairly common 20-ft to 30-ft structural span, Table 47 in Chapter 48 of 2015 ASHRAE Handbook—HVAC Applications recommends vibration isolators with 1.5-in. static deflection.

Vibration isolators require rigid support to function properly. Rigid support means at least 10 times as stiff as the isolator spring or deflection no more than 1/10 the isolator design static deflection. To be effective, a 1.5-in. deflection spring has to sit on a structure that deflects no more than 0.15 in.—between 1/8 in. and 3/16 in.

Structural engineers often design to allow a roof structure to deflect up to 1/360 of the span under normal load. Therefore, a 30-ft span could deflect as much as an inch in the center of the bay. That structure would need additional stiffening for a vibration isolator to work effectively.

Besides vibration, there is noise. A 20-ton rooftop unit might have an Air-Conditioning, Heating, and Refrigeration Institute sound-power rating of 94 dB. A roof structure consisting of an insulated steel deck is largely transparent to noise, so much of that sound will penetrate to the occupied space below. Adding 3 in. of concrete to the structural bay under the rooftop unit will provide transmission loss and acoustical mass to cut noise transmission.

Consult the structural engineer regarding the weight of the pipes and ducts a structure will have to support.

In “43rd Edition Standard Specifications and Load and Weight Tables for Steel Joists and Joist Girders,” the Steel Joist Institute advises that uniformly distributed loads of up to 100 lb can attach to any point on the top or bottom chord of a joist with negligible effect on the joist. Heavier loads must attach at panel points (points where the diagonal braces meet the chord of the truss) or have welded struts that transfer the concentrated load to a panel point on the opposite chord. Joist manufacturers can design joists to accommodate heavy concentrated loads, but they need the load information before the joists are fabricated. Besides the size of the load, check with the structural engineer regarding the amount of eccentricity, if heavy loads are attached to the edge of a joist or beam.

Verify voltage characteristics with the electrical engineer.

A contractor friend says you can never check voltage often enough. Here’s why:

A 20-ton air-conditioning compressor designed to operate at 208 volts/3 phase has a power input of 22.3 kW and a rated current of 72.5 amps. The same compressor operating on 480 volts has the same rated power input and a rated current of 31.4 amps.

If a 480-volt compressor is connected to a 208-volt power supply, Ohm’s law predicts a current flow of 13.6 amps ([208 ÷ 480] × 31.4). It may be somewhat more because a motor will draw as much current as it needs to run its load, but it most likely will be considerably less than the rated amps. If the compressor does run, it probably will not deliver anywhere near rated capacity. That problem can be solved after the fact with a 208:480-volt step-up transformer, but at unplanned expense and with lifelong operating expense for the few percent of transformer losses.

If a 208-volt compressor is connected to a 480-volt power supply, the results can be more exciting. Ohm’s law predicts a current flow of 167.3 amps ([480 ÷ 208] × 72.5), or 2.3 times rated current. The circuit breaker might not trip right away because 2.3 times current does not look like a short circuit, even when scaled up for motor starting inrush current. Therefore, 2.3 times rated current will flow (at least briefly) through the motor windings. The resulting I2R heating in the windings is 2.32, or 5.3 times as much heat as the motor cooling is designed to dissipate. Because this is a hermetic refrigeration motor compressor, the motor does not get much cooling until the refrigeration has run for at least a few minutes. So, the motor burns up, and an expensive compressor has to be replaced, as does the contaminated refrigerant.

Check the voltage!

Giving the electrical engineer a list of the HVAC equipment needing power also can help. Chillers, pumps, air-handling units, and rooftop units are pretty obvious; an electric heater in the sprinkler room, a small induced-draft fan, or an electric damper motor here and there, however, can be easy to miss. The electrical engineer needs to hear from the plumbing engineer and fire-protection engineer about equipment needing power, too. One engineering firm includes a combination mechanical/electrical schedule sheet on every project. The sheet lists each piece of mechanical equipment and its electrical characteristics and accompanies both the HVAC and electrical drawings.

Coordinate with the plumbing engineer regarding condensate drainage.

Local codes might or might not let condensate be dumped by rooftop units onto roofs and flow into storm drains. I have seen sites where condensate had to be piped to the roof drain (at extra cost if not shown on the drawings).

Check local requirements for condensate from condensing boilers. Even though condensing-boiler condensate is no more corrosive than Coca-Cola, local codes might call for its neutralization before it is dumped down a drain.

Local codes and regulations might designate the drains that can accept condensing-boiler condensate. For example, neutralized boiler condensate does not fit the Massachusetts Plumbing Code definition of “clear water waste,” so it cannot be discharged into a storm drain. It also does not fit the definition of “sanitary sewage,” so it cannot be discharged into an on-site sewage-disposal (septic) system. For sites not served by a municipal sewer system, the regulations seem to require an industrial-waste holding tank, meaning owners have to hire an industrial-waste hauler to remove neutralized condensate. In such cases, it might be more practical to use a non-condensing boiler.

HVAC and plumbing drawings need to show clearly the division of responsibility for equipment connecting to both HVAC and plumbing systems. The list includes indirect water heaters and makeup-water systems for boilers, chillers, and cooling towers. Be explicit regarding:

- Which trade provides the indirect water heater and which trade makes specific connections (boiler water, incoming city water, outgoing domestic hot water, and recirculated hot water).

- Which trade provides backflow prevention required by a makeup-water system. Where does the plumbing piping end and the HVAC piping begin?

Check locations of plumbing vents. The plumbing code, the building code, or an applicable standard might require a specified separation between plumbing vents and outdoor-air intakes.

Discuss with the fire-protection engineer spaces that need heat to protect sprinkler pipes.

Section 8.16.4.1 of NFPA 13-2013, Standard for the Installation of Sprinkler Systems, calls for the protection of sprinkler pipes against freezing. Though identifying spaces that need heat to protect sprinkler pipes may be the primary duty of the fire-protection engineer, it does not hurt for the HVAC engineer to ask. Spaces the HVAC engineer considers unconditioned or unoccupied might need heat for freeze protection. An electric unit heater set at 50°F can be a cost-effective choice for a small room on an outside wall away from a heating hot-water supply line.

Check and coordinate to ensure firestopping gets done.

Pipe and duct penetrations through fire-resistance-rated walls, partitions, floors, and ceilings need firestopping to protect against the spread of fire. On some projects, each trade is responsible for firestopping its own openings. On others, all firestopping is assigned to a single specialty contractor. The question of who specifies firestopping and who does the work is far less important than checking and coordinating so the work gets done.

Pilots and the military are no strangers to checklists. Pilot Chesley “Sully” Sullenberger safely landed US Airways Flight 1549 on the Hudson River after bird strikes caused both engines to fail. He attributed his success partly to an emergency-procedures checklist. Developing and using project-coordination checklists might help HVAC engineers, too.